Once upon a time, in a world dominated by traditional financial systems, a new kid on the block emerged, shaking things up like never before. This new phenomenon, known as “tokenization of financial assets,” promised to revolutionize the way we perceive and interact with the financial universe. Picture this—a world where your real estate, art, or even your favorite soccer team’s shares can be chopped up into digital slices and traded like Pokémon cards. Okay, maybe not exactly, but you get the vibe. Welcome to the future of finance!

Read Now : Secure Electronic Voting Systems

What is Tokenization of Financial Assets?

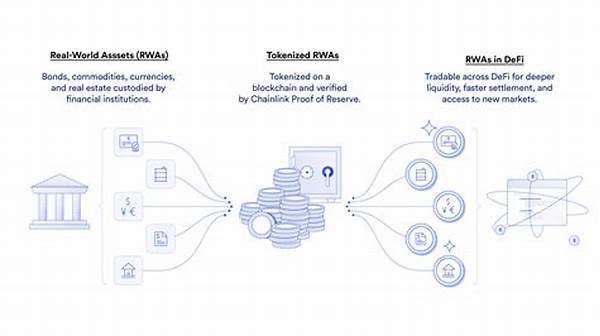

Alright, so you’re probably wondering, “What’s this tokenization of financial assets all about?” Well, imagine taking massive, pricey assets and breaking them down into smaller, digital tokens. These are then like shares that can be traded easily on the blockchain—yep, that fancy digital ledger technology that’s making waves everywhere. It’s like turning your grandma’s antique vase into hundreds of little pieces people around the globe can own a part of, without needing to physically hold a piece. This basically democratizes investment, allowing you and me—even with shallow pockets—to invest and own a slice of assets previously reserved for the rich and mighty. Easy-peasy, right?

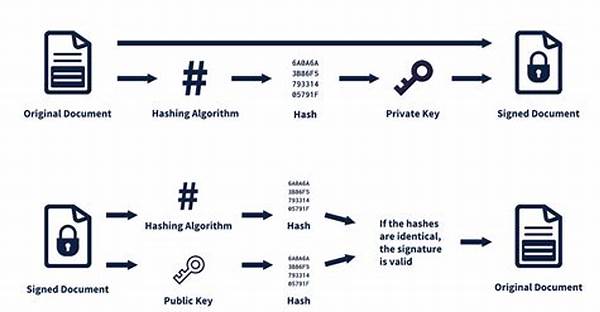

With tokenization of financial assets, we’re talking real-deal transparency and efficiency. Gone are the days of endless paperwork and middlemen taking a cut of your hard-earned cash. The blockchain handles all transactions, making them secure and tamper-proof. Plus, trading can happen 24/7, so you don’t have to wait for Wall Street to open its doors. Whether it’s your dream of owning a slice of a Parisian apartment or a piece of vintage art, tokenization is making this more accessible. Stay tuned, because this is where the future is heading!

Advantages of Tokenization of Financial Assets

1. Accessibility: Tokenization of financial assets makes investing achievable for everyone by lowering the cost of entry. It’s not just for the Wall Street big shots anymore!

2. Liquidity: Tokenization of financial assets turns what used to be illiquid into something you can easily trade. You’re now the master of quick buys and sells, without hassle.

3. Transparency: With all transactions recorded on the blockchain, tokenization ensures crystal-clear transparency. You can kick back, knowing everything’s legit and above board.

4. Efficiency: Say goodbye to never-ending paperwork! Tokenization of financial assets cuts out the intermediaries because who needs an extra mouth to feed when you can handle things yourself?

5. Fractional Ownership: Ever dreamt of owning a fraction of the Mona Lisa? Tokenization makes it possible, by letting you own a piece of high-value assets with just a click.

Potential Risks in Tokenization of Financial Assets

Now, don’t get it twisted, tokenization of financial assets ain’t all sunshine and rainbows. There’s the risk element that comes with any groundbreaking tech. This whole blockchain stuff might sound futuristic, but not everyone is onboard yet. Some peeps are still skeptical, questioning the security and potential for hacking. You know how it is with new tech—people fear what they don’t totally get. Then there’s the regulatory landscape, which can be murky. With different countries playing by different rules, things can get a bit tangled. But hey, that’s part of the adventure, right?

Read Now : Leadership Roles For Women In Blockchain

Let’s not forget about volatility. We’re talking digital assets, so prices can swing wildly, faster than you can say “cryptocurrency.” It’s a rollercoaster ride—not for the faint-hearted. However, knowing the risks means you can arm yourself with the knowledge to navigate this brave new world. Tokenization of financial assets might be the wild west for now, but who doesn’t like a bit of the unknown?

Real-World Applications of Tokenization of Financial Assets

Tokenization of financial assets ain’t just some distant fantasy; it’s already happening! Real estate is one of the hottest areas for tokenization, letting people own property pieces from swanky apartments in New York to charming villas in Tuscany. The art world ain’t missing out either, with masterpieces being sliced into tokens for art lovers to invest in. And let’s not even start on the music industry, where musicians offer tokenized portions of their royalties to fans. It’s like being a mini stakeholder in your favorite artist’s success. Crazy, right? But that’s the power of tokenization!

And how about sports teams allowing fans to buy tokens representing shares in team revenues? It’s fandom taken to a whole new level, where you literally invest your heart and soul into your team. As tokenization of financial assets gains momentum, who knows what other exciting applications we’ll see? Get ready, because this revolution is just getting started.

Challenges and Future of Tokenization of Financial Assets

Despite the awesomeness of tokenization, not everything is smooth sailing. The big bad bears here include blurry regulations, lack of standardized protocols, and the technological hurdles of adopting blockchain. If you’re planning to dip your toes into this pool, make sure you’ve got your strategy hat on. Understanding the shifts in regulatory landscapes and keeping up with tech updates is gonna be crucial. The tokenization of financial assets still has a way to go, but the potential is explosive.

Imagine a world where tokenized assets are as common as owning stocks. Scaling up requires teamwork across borders, smashing down tech barriers, and fostering trust. It’s a heck of a ride, but with the right determination, this could redefine finance as we know it.

Conclusion on Tokenization of Financial Assets

So, what’s the lowdown on the tokenization of financial assets? It’s a game-changer, bringing a wave of new opportunities and challenges. Democratizing access to high-value assets, enhancing transparency, and improving efficiency are the headlines. But like any revolution, it comes with its risks and hurdles. Being savvy with tech and the evolving regulatory climate is vital. Whether you’re a skeptic or a believer, tokenization is reshaping the landscape of finance, inviting everyone to join the party. Embrace the future, because ready or not, here it comes!