Once upon a time, in a world where physical assets like paintings, real estate, and precious metals were only dreamed of in tangible forms or by those with hefty bank accounts, a magical power called “tokenization” began to take shape. This power promised to turn these solid, physical treasures into digital entities—tiny, tradable pieces that lived in the vast realm of blockchain. As this tale unfolds, we explore the enchanting transformation known as the tokenization of real-world assets.

Read Now : Influential Women In Cryptocurrency Innovation

The Buzz About Tokenization

Alright, imagine this: you’re chillin’ with your buddies, talking about crypto, and someone drops the term “tokenization of real-world assets.” You’re instantly like, “Huh?” But then, it clicks. Think of it like this: you take something dope, like your favorite band’s rare vinyl, and digitally slice it so everyone can own a piece. No need to fork out big bucks upfront, man. It’s like crowdfunding, but instead of hoping for a cool gadget to get made, you’re snagging a share of something that’s already valuable. It’s wild how this concept totally flips the script on owning stuff. Tokenization of real-world assets is the real deal, giving everyday peeps a shot to dive into investments that were once only for the elite.

So, the next time your pal talks about that sweet beachfront property or fancy painting that’s been locked away from us mere mortals, just picture it being split into bits and bytes. It’s not magic; it’s tech! This magic called tokenization of real-world assets is opening doors, connecting us to opportunities in ways we never dreamed possible. Want a taste of that fancy art without robbing a bank? You got it! The future of ownership is digital, diverse, and dang exciting.

Why Tokenize?

1. Breaking Barriers: No more gatekeeping! Tokenization of real-world assets lets everyone in on the pricey stuff without needing a trust fund background.

2. Flexibility: You’re not stuck owning the whole thing. Grab a slice, enjoy the vibe, and balance your investments like a pro.

3. Fractional Ownership: Want a piece of a Picasso? With tokenization of real-world assets, it’s not some far-fetched fantasy.

4. Liquidity Boost: Selling your asset shares can be as easy as pie. Need cash? Trade your tokens in the blink of an eye.

5. Transparency: Forget shady biz deals. Blockchain ensures each transaction is clear as day, making tokenization of real-world assets super legit.

Read Now : “blockchain Applications In Fraud Prevention”

The Process Unwrapped

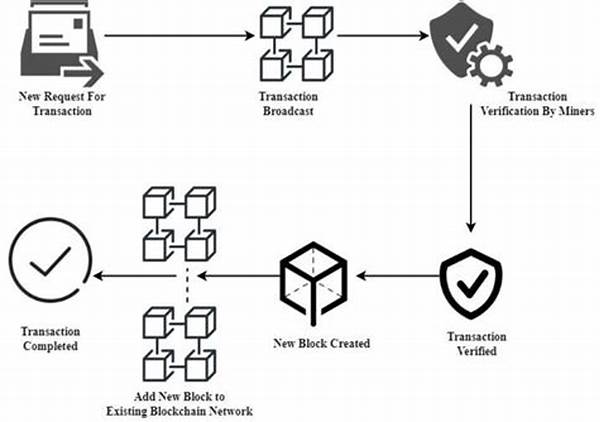

Now that we’ve established how cool tokenization of real-world assets is, let’s get into the juicy bits of how it all works. Picture an asset—a swanky loft in downtown. Traditionally, buying into would be a headache. But with tokenization, it becomes as breezy as a Sunday brunch. You slice that asset into digital tokens, each holding a piece of its value. Suddenly, you’re not just wishing you owned part of a loft; you actually do, albeit digitally. Every transaction sits on the blockchain, keeping everything transparent, ensuring that tokenization of real-world assets is more secure than your grandma’s cookie jar. And the best part? You get to dive into various kinds of assets: from real estate to fine art, without needing a fortune. It’s a whole new world of opportunities, folks.

Dive into the Tech

Alright, techies, let’s geek out for a sec. At the core of tokenization of real-world assets is the blockchain—the superstar that’s been flexing its muscles in crypto circles. This bad boy ensures every token exists, making fraud nearly impossible. When assets hit the blockchain as tokens, you’ve got a digital paper trail of ownership that’s more airtight than Tupperware. And with smart contracts in play, the whole system is automated, meaning those messy middleman fees? Gone. Tokenization of real-world assets is like upgrading from flip phones to smartphones: it’s a sleeker, smarter way to handle business.

Real-World Examples

One day, tokenization of real-world assets ain’t just a sci-fi plot—it’s happening now! Real estate agencies are transforming condos into tokenized investments. Fine art galleries are hopping on board, too. They’re treating those million-dollar paintings like shares, so you’re not stumped by the price tag anymore. Commodities, rare wine collections, and even music royalties are waving the token flag, inviting everyone to the investment party. The tech may sound complex, but the outcome is simple: more people getting a piece of financial freedom.

Imagine the Future

Imagine cruising through a virtual marketplace, picking up a piece of a luxury hotel or a shiny sports car, all without leaving your couch. Tokenization of real-world assets aims to keep making investing a communal affair, accessible and diverse. As this journey continues, the economics of ownership will forever change. So, while the old ways of hoarding entire properties and fortunes might be evolving, the spirit of ownership remains. In this new universe, everybody gets a share, bringing a fresh spin to how we see assets and investment.

Wrapping It Up

To sum it up, tokenization of real-world assets is the revolution we didn’t see coming but totally needed. It flips the dynamic of how we view and invest in stuff around us. The word’s out—whether you’re eyeing a piece of property or a valuable vintage collection, tokenization is bridging that gap. Owning tangible assets isn’t for the few; it’s for everyone. It’s not just a trend; it’s a movement redefining asset investment. As this digital story unfolds, one thing’s for sure: tokenization of real-world assets is here to stay, ready to change our financial landscape one token at a time.