Once upon a time, in the bustling metropolis of Techville, there was a group of insurance companies struggling with a big, messy problem—claims transparency. Navigating through piles of paperwork and dealing with frustrated clients became the norm. Enter stage left: blockchain technology, and with it, hopes of revamping the chaotic claims process. It promised a world where everything was clear, recorded, and as trustworthy as a best friend. But was this hype, or reality?

Read Now : Blockchain-driven Virtual Economic Structures

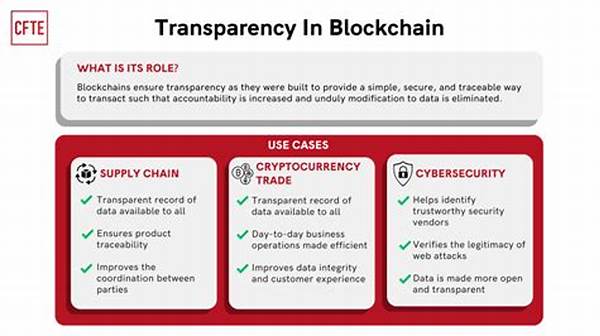

How Blockchain is Changing the Game

In the ever-evolving world of insurance, “enhancing claims transparency through blockchain” is more than just a buzzword; it’s a revolution. With blockchain, every claim transaction becomes a secure, tamper-proof record. Think of it as an incorruptible diary, but instead of teenage secrets, it keeps track of insurance data. Trust is the name of the game, and blockchain is here to secure the win. Plus, say goodbye to endless back-and-forths. Everything gets logged once, and everyone on the blockchain gets to see the magic happen—no hidden agendas, no fine print surprises. You can call it insurance claims on steroids, but with a chill vibe.

Benefits of Blockchain in Insurance

1. Security Goals Met: When it comes to enhancing claims transparency through blockchain, security is top-notch with encrypted data that hackers loathe.

2. Say Bye to Fraud: Blockchain’s transparency means fewer bad actors slipping through the net. Fraudsters, beware!

3. Flex in Efficiency: Automated processes in claims handling mean that delays are so last decade.

4. Collab Central: Stakeholders like insurers, claimants, and regulators communicate better. Everyone’s in the loop.

5. Paperless Plains: Going green isn’t just cool; it’s the future. Blockchain helps ditch the paper trails for digital ones.

Real-World Applications

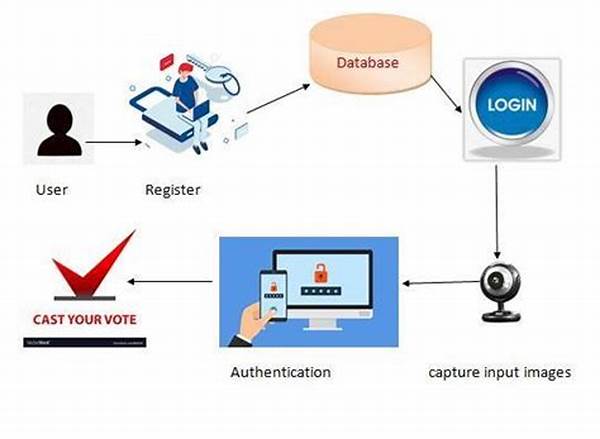

In today’s insurance industry, enhancing claims transparency through blockchain isn’t sci-fi—it’s the real deal. Companies are using blockchain tech to track policy agreements and claims in real-time. Imagine this: you file a claim after that unfortunate fender bender, and voilà, the details get locked in without any human intervention. Each step—document submission, validation, payout—is recorded immutably. No more waiting in suspense, wondering if someone misplaced your claim form. Businesses love it, clients trust it, and the environment celebrates less paper waste.

Blockchain acts like a digital bouncer ensuring only the right folks have access to data, banishing unauthorized peeps to the curb. Insurers can cross-reference data with ease, reducing discrepancies and ensuring accuracy. Plus, blockchain’s automated nature minimizes human error, meaning fewer uh-oh moments. It’s like having a super smart AI working behind the scenes, all toward enhancing claims transparency through blockchain.

Read Now : International Renewable Energy Cooperation

Challenges in Adoption

But let’s not pretend it’s all roses and unicorns. Embracing blockchain tech for enhancing claims transparency through blockchain has its obstacles. Traditional systems are stuck in the past, and shaking things up requires a whole lotta change and cash. There’s a learning curve too, a steep one. Not everyone speaks “blockchain fluently,” and training, while essential, takes time. And what about regulation? This tech might be cool, but it also needs to play nice with existing laws, which can be a major balancing act.

Businesses face questions of scalability—can the blockchain handle bursts of claim data traffic like a boss, or will it crash and burn? And let’s not forget the tech-phobic folks who prefer ye olde paperwork over digital legerdemain. For blockchain to truly enhance claims transparency, these hurdles need tackling head-on.

Future Possibilities

So, what’s next for enhancing claims transparency through blockchain in the insurance world? Picture a world where smart contracts automate payouts in seconds, reducing processing times from weeks to moments. Fewer disputes over who said what when, since every transaction and conversation is shackled in the blockchain’s immutable chains. The dream? Global adoption, where insurers worldwide dance to the unified tune of transparency, with blockchain orchestrating the harmony.

Blockchain could bridge the gap between insurers, regulators, and policyholders worldwide, offering a seamless experience that feels more like a social media scroll-through than a bureaucratic nightmare. It’s about making insurance less of a headache and more of a straight-shooting process. Bottom line: it’s transparency, dialed up to eleven.

Conclusion

To sum it up, enhancing claims transparency through blockchain is like giving the insurance industry a much-needed makeover. It promises security, efficiency, and most importantly, trust. Imagine a world where clients aren’t left in the dark, and insurers sleep easy knowing everything’s on the up-and-up. Blockchain holds the key to unlocking this new era. Sure, there are bumps in the road, but the potential pay-off is huge. By embracing and adapting to blockchain tech, a not-so-distant future of hassle-free insurance claims is well within reach. The tech-savvy minds in Techville are already on the case—are you ready to join them?