There was once a little digital realm, bustling with thriving marketplaces, colorful exchanges, and mysterious new currencies. This was the land of cryptocurrencies, where traders and enthusiasts wandered, seeking fortunes and new discoveries. Amidst this technological tapestry, a new trend emerged that would take the land by storm—peer-to-peer cryptocurrency lending. Imagine this as a modern-day twist to age-old bartering, where tech-savvy individuals connect directly to lend and borrow digital assets, cutting out the middleman and surfing the waves of decentralized finance. Let’s embark on a journey through this fascinating landscape.

Read Now : Inspiring Stories Of Women In Blockchain

What Is Peer-to-Peer Cryptocurrency Lending?

Picture this: you’ve got some spare Bitcoin or Ethereum sitting in your digital wallet, chillin’. Meanwhile, somewhere across the globe, another crypto enthusiast is just itching to get their hands on that very crypto to fire up their latest venture. That’s where peer-to-peer cryptocurrency lending struts in like the superhero of decentralized finance. It’s real talk without brokers or big banks, just straight-up peer connections.

In this wild west of finance, borrowers and lenders meet over virtual campfires at platforms like Celsius or BlockFi. Lenders put their idle crypto to work, earning interest on the sly. Borrowers get the funds they crave without drowning in paperwork. It’s all quick and smooth like butter, right on the blockchain. Forget the suits and endless forms, this is crypto lending in its raw, unfiltered form.

But why would anyone dive into peer-to-peer cryptocurrency lending? Well, simple: it’s the thrill of higher interest rates and being part of an edgy financial revolution. TradFi (traditional finance) is cool and all, but DeFi (decentralized finance) is the new rockstar blazing through the economy. This lending gig ain’t just profitable; it’s transforming how we think about money in a borderless digital age.

How Does Peer-to-Peer Cryptocurrency Lending Work?

1. Sign Up & Connect: Get started by joining a legit platform for peer-to-peer cryptocurrency lending.

2. Set Up Your Profile: Make your digital self shine. Input your preferences and stake your crypto.

3. Match & Lend: Algorithms shoot their shot, matching borrowers with lenders. Get ready for some crypto action!

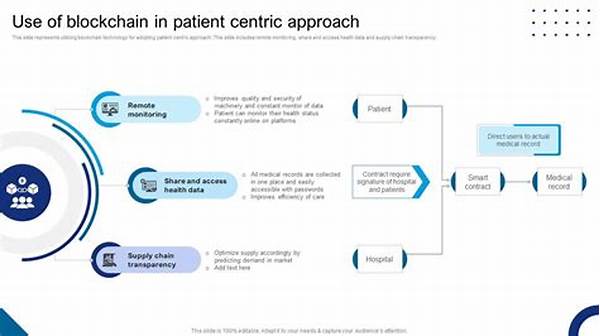

4. Smart Contracts: All secured by encrypted promises—smart contracts ensure everyone gets their dues, nice and easy.

5. Earn or Borrow: Lenders get interest; borrowers get those digit-coins. Everyone’s happy in this digital ecosystem!

The Perks of Peer-to-Peer Cryptocurrency Lending

When you dive into peer-to-peer cryptocurrency lending, it’s like getting front-row tickets to the finance rave of the future. This scene is hot because it’s decentralized, giving power back to the people. No middlemen, no hassle.

And let’s rave about the returns: they can be pretty sweet. Interest rates often outshine those traditional savings accounts. Plus, the thrill of playing in the crypto sandbox is unbeatable. You’re not just a passive player; you’re part of a revolution that’s changing how we think about borrowing and lending.

But hey, it’s not all about the cash. It’s about being in a trend that’s all about empowerment and innovation. You’re taking finance into your own hands, weaving your own digital tapestry. Whether you’re lending or borrowing, you’re riding the wave of a new financial frontier that’s all about you.

Challenges in Peer-to-Peer Cryptocurrency Lending

1. Volatility Vibes: Crypto prices hit those rollercoaster highs and lows—stay strapped in, y’all!

2. Security Stakes: Keep it locked. Secure wallets and legit platforms are your best friends here.

3. Tech Troubles: Blockchain can be a handful. Get savvy, stay informed, and don’t sweat it too much.

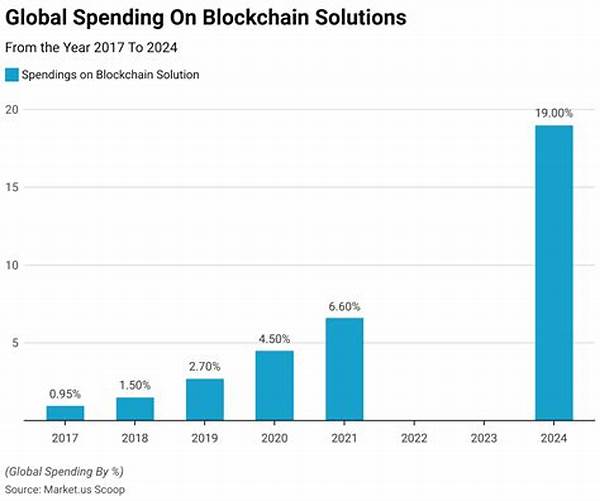

Read Now : Future Outlook On Blockchain Markets

4. Regulatory Riddles: Governments are catching up. Stay updated to keep everything kosher.

5. Scam Saga: Be alert! The digital world has its share of shady characters lurking about.

Is Peer-to-Peer Cryptocurrency Lending Right for You?

Thinking about joining the peer-to-peer cryptocurrency lending party? Hold up! Not everyone’s a fan of this wild ride. But if you’re a thrill-seeker with an appetite for innovation, it might just be your thing. Your journey in this realm starts with a digital foot forward.

Do your homework! The world of crypto lending isn’t your typical day at the beach. It’s more like scaling a digital Everest, complete with its own set of risks and rewards. Bolster up with the right knowledge, pick your partners wisely, and get ready for one heck of a journey.

And let’s not forget about the satisfaction that comes from being a trailblazer in a financial revolution. Cryptocurrency lending can be an empowering choice if it aligns with your financial goals and risk appetite. So, are you ready to jump in and see what this brave new world has to offer?

The Evolution of Peer-to-Peer Cryptocurrency Lending

Peer-to-peer cryptocurrency lending didn’t just poof into existence. Nah, it’s been evolving, like a tech-driven phoenix rising from the ashes of traditional finance. This digital revolution has flipped the script for many who once felt sidelined by conventional banking systems.

Society today craves flexibility and autonomy. Peer-to-peer cryptocurrency lending dishes out exactly that, shattering barriers that once made lending and borrowing a bureaucratic nightmare. Now, it’s all about blazing trails and forging connections over virtual platforms that speak the language of the future.

As these systems grow, they promise more inclusive opportunities, granting anyone with an internet connection access to participate, profit, and innovate. The transformation grips us with the promise of a decentralized tomorrow, where big players don’t dictate the rules, and freedom truly reigns.

Peer-to-Peer Cryptocurrency Lending: The Future Awaits

In conclusion, peer-to-peer cryptocurrency lending is like catching the digital wave of decentralized opportunity, where anyone can hang ten and ride towards financial freedom. Forget the stiff corridors of traditional banks; it’s all about thriving on blockchain avenues and having a say in your financial destiny.

As the digital realm continues to expand, lending platforms will become even more robust and accessible, altering how we perceive and interact with money. The possibilities are endless, and the horizon’s inviting. Jump on this train if you’re ready to be part of the narrative as finance and technology coalesce into one potent force.

Let your curiosity lead you, your enthusiasm fuel you, and your caution guide you. The future lies in embracing new paradigms, and peer-to-peer cryptocurrency lending might just be your gateway to financial evolution—an epic adventure in a world where currencies flex and grow beyond today’s earthen confines.