Once upon a digital time, in the world of insurance claims, chaos reigned supreme. Folks were buried under mountains of paperwork, waiting for approvals longer than waiting for your favorite band’s reunion tour. But just when hope seemed lost, tech wizards conjured up something called “automated insurance claims blockchain solutions” to save the day. These solutions promised to revolutionize the insurance industry, making the claim process faster, more secure, and totally stress-free. Let’s dive into this tale of technological triumph.

Read Now : Enhancing Global Intellectual Property Protection

What are Automated Insurance Claims Blockchain Solutions?

Imagine never having to fill out an endless stack of forms or wait an eternity for a claim to process. This dream is now a reality with automated insurance claims blockchain solutions. These nifty innovations blend automation with blockchain’s transparency and security. Picture it: your claim zooms through the system, verified faster than you can say “blockchain.” It’s not just about speed; it’s about trust. These solutions use the immutable nature of blockchain to ensure all parties involved have a crystal-clear, tamper-proof view of the claim’s status. With everything automated, you’re left with more time to do the things you love, like binge-watching your favorite shows or finally starting that hobby you’ve been putting off. In this digital age, these solutions are like your own insurance superheroes, flying through paperwork faster than a bullet.

Why We Need Automated Insurance Claims Blockchain Solutions

1. Speedy Gonzales: Claims get processed in record time, thanks to automation and blockchain working together.

2. No More Waiting: Forget the days of endless queues; approvals happen lickety-split.

3. Trustworthy: Blockchain provides a transparent system that’s harder to crack than your grandma’s cookie recipe.

4. Secure AF: Say goodbye to fraud with blockchain’s top-notch security features.

5. User-Friendly: These solutions are as easy to navigate as your favorite social media app.

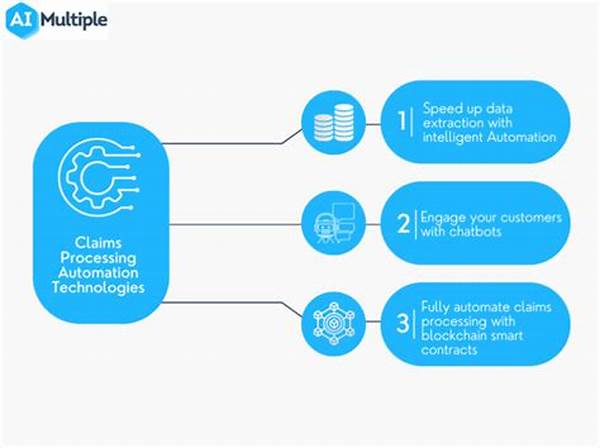

The Magic Behind Automated Insurance Claims Blockchain Solutions

Let’s break it down. At its core, automated insurance claims blockchain solutions use smart contracts. These digital contracts execute automatically when certain conditions are met. What does this mean for you? No more manual intervention or pesky human error. Everything happens like clockwork, with precision and accuracy. Your claims get processed seamlessly, and you can track the entire journey in real-time. Plus, blockchain’s decentralized nature means there’s no single point of failure. It’s like having a safety net that never sleeps. The synergy of automation and blockchain technology offers a powerful, double-punch solution that’s transforming the insurance sector one claim at a time.

Exploring the Benefits of Automated Insurance Claims Blockchain Solutions

1. Efficiency: Manual claims are slow. Automation speeds things up as fast as a rollercoaster ride.

2. Cost-effective: Save on operational costs while increasing profit margins.

3. Fraud Prevention: With blockchain, every transaction is recorded and unchangeable, making fraud nearly impossible.

4. Accuracy: Automation ensures that details are recorded correctly and quickly.

Read Now : Fault-tolerant Storage Consensus Solutions

5. Transparency: Everyone in the process sees the same data, making disputes rarer than a unicorn.

6. Decentralization: With no central authority, the risk of data manipulation is minimized.

7. Environmentally Friendly: Less paperwork = fewer trees cut down. Mother Nature says thanks!

8. Customer Satisfaction: Happy customers are the cheering fans of your business world.

9. Innovation: Stay ahead of the competition by being an industry trendsetter.

10. Scalability: Easily scale operations without a hiccup, no matter how much your client base grows.

The Future of Automated Insurance Claims Blockchain Solutions

As we venture further into the world of automated insurance claims blockchain solutions, it’s clear that the future is bright. These innovations are redefining what it means to process insurance claims in an era where efficiency and transparency are key. With each passing day, more insurers are adopting these systems, realizing their potential not just to streamline operations but to create a customer experience second to none. Imagine a world where every claim is handled with the precision of a Swiss watch, and clients walk away with a smile that stretches from ear to ear. That world is closer than ever, and it’s fueled by blockchain technology and automation’s dynamic duo.

Navigating the Change with Automated Insurance Claims Blockchain Solutions

Transitioning to automated insurance claims blockchain solutions might seem like a herculean task, but it’s a journey worth taking. Think of it like switching from dial-up to fiber optic—a little bit of change for a whole lot of improvement. The shift paves the way for insurers to become customer-centric, up their game, and keep up with the fast-paced digital world. Yes, there’s a learning curve, but embracing this change is key to prosperity. Say goodbye to old-school, snail-paced claims processes and embrace the future of automated efficiency. The transition might feel like uncharted waters, but once you set sail on the blockchain ship, you’ll find it’s a smoother ride than ever imagined.

Summing Up Automated Insurance Claims Blockchain Solutions

Embracing automated insurance claims blockchain solutions isn’t just about being trendy; it’s about smart business. These solutions bring transparency, speed, and security that are a must in today’s fast-paced industry. It’s like giving your business a superpower that translates into happier customers and a more efficient operation. The fusion of blockchain with automation heralds a new era where claims are no longer a pain, but a breeze. As the digital age advances, so must our ways of handling processes, and automated insurance claims blockchain solutions are leading this digital revolution. They’re here to stay, changing the landscape of insurance one block at a time.