In the world of insurance, where paperwork piles up like an endless mountain and any progress feels as slow as dial-up internet, imagine a story where technology rides in like a hero on horseback. Meet Alex, an insurance adjuster drowning in claims and dreaming of a world where transparency and efficiency aren’t myths. Just as Alex was about to give up, an email pinged: “Automating insurance claims with blockchain.” Curiosity piqued, Alex delves into this world-changing technology, ready to transform the insurance landscape.

Read Now : Pioneering Female Figures In Blockchain Innovation

The Magic of Automating Insurance Claims with Blockchain

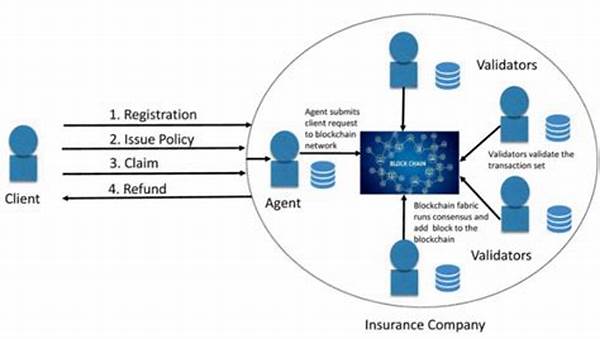

So, imagine Alex’s excitement learning about how automating insurance claims with blockchain is the new cool kid on the block (chain). This tech doesn’t just speed up processes; it’s like giving them a turbo boost. It wipes out fraud with its swanky decentralized system, making everything open and honest. Now, instead of playing detective with claim paperwork, Alex can watch as blockchain does the heavy lifting, verifying information faster than you can say “paperless.” Plus, with the blockchain, Alex’s evenings have become free of exhausting overtime, and filled instead with much-needed Netflix binges.

Insurance companies are jumping on this bandwagon since automating insurance claims with blockchain is just too good to pass up. It’s all about turning those endless hours of form-juggling into a breezy process, kinda like turning winter into summer. Imagine using your smartphone to file a claim and, thanks to blockchain’s real-time processing prowess, watching it unfold without delays or hitches. Stressful wait times? Thing of the past. It’s all about transparency and speed now, and that’s something to get hyped about.

How Automating Insurance Claims with Blockchain Works

1. Speedy Gonzales: It’s like giving the insurance process a shot of adrenaline, drastically cutting down waiting times. You know those moments at the DMV? Yeah, blockchain makes sure that experience stays only at the DMV.

2. Fraud Prevention Pro: With its decentralized system, blockchain is like Sherlock, sniffing out and eliminating fraud before it even starts.

3. Real-time Tracking: Ever wished you could stalk your pizza delivery in real time? Now imagine doing that with insurance claims. Say goodbye to stress and hello to transparency.

4. Security Mojo: Blockchain’s security protocols are like having a bodyguard for your data. Keeping it safe, encrypted, and oh-so-chill.

5. Cost Cutter: By automating insurance claims with blockchain, expenses drop like it’s hot, reducing costs for both companies and users. Savings all around!

The Real Deal with Automating Insurance Claims on Blockchain

Think of traditional insurance claims as that old dial-up internet from the ’90s — painfully slow and frustrating. Enter automating insurance claims with blockchain, the fiber optic upgrade we didn’t know we needed. It brings in the cool factor with its decentralized system, cutting out the middleman and making everything move faster than a cheetah on a treadmill. For Alex and the crew, this means less time spent wrangling mountains of paperwork and more time for strategies that actually make insurance better, faster, stronger.

Blockchain’s magic trick isn’t just speed in automation; it’s all about trust. With all information locked away safely where only those in the know can see it, customers and companies can chill knowing there’s no funny business going on. Despite feeling futuristic, this tech is easy-peasy to use, even for folks who still ask, “What’s a blockchain?” It’s the future of insurance claims, peeling away the complexity and rolling out the welcome mat for simplicity.

Big Wins of Automating Insurance Claims with Blockchain

1. Trust Factor: Blockchain gets everything out in the open, earning mad trust points from users to companies alike.

2. Lazy No More: Gone are the days of procrastination. When processes zip along, results come quicker than ever.

3. Eco-friendly Vibes: With paper out of the picture, automating insurance claims with blockchain is giving Mother Earth a virtual high-five.

4. User-Friendly: Tech should be easy, like Sunday morning, and blockchain makes it so. Intuitive processes mean even technophobes are won over.

Read Now : Addressing Supply Chain Information Gaps

5. Innovation Station: Once the heavy lifting is done by blockchain, companies can focus on creating cool, innovative insurance solutions. Go, team!

6. Global Game Changer: Blockchain doesn’t care about borders; it makes international claims as breezy as a local call.

7. Win-Win Situation: Customers get their claims sorted quicker, and insurance companies save on operational costs. Everyone’s smiling.

8. Neighborly Neighborhood: Imagine an insurance world new and improved, with a trustee community-sharing spirit backed by data verification.

9. Adaptation Nation: While the future seems unpredictable, with blockchain, the transition becomes smoother than jazz. Ready, set, claim!

10. Tailored Solutions: It’s all about making insurance a customizable experience, matching each individual’s needs as they arise — the future is bright with options!

Why Automating Insurance Claims with Blockchain is a Big Deal

So, Alex and the team have stepped into the future, seeing the wonders of automating insurance claims with blockchain unfold around them. What was once a dream is now a reality, with a tech-driven insurance world where every claim moves like clockwork, untouched by frustrating delays. From unparalleled transparency to adopting an eco-friendly model, this tech offers efficiency and appeal. And while the present feels exhilarating, the future is set to be even more thrilling.

In this new era, blockchain isn’t just a buzzword but a diligent colleague, ever ready to sort, manage, and protect data. The automation journey has only just begun, with decentralization making global claims seamless and sustainable. For Alex, this ride has shifted from paperwork woes to the thrill of technological triumph, and it’s a shift worth celebrating.

In Conclusion: The Future and Beyond

The quest to simplify and enhance insurance continues. As automating insurance claims with blockchain gains traction, it paves the way for revolutionary changes, bypassing the mundane tasks of yesteryear. The insurance sector’s adoption of blockchain is just the start of eliminating inefficiencies and forging something better. As companies embrace this technology, policyholders and industry professionals hold on tight for a roller-coaster ride into an efficient future.

The narrative sparked by blockchain’s adoption inspires change, not just for Alex but for everyone in the insurance realm, ensuring a smoother, faster, and more transparent process. As blockchain continues to enhance automation, the sky’s the limit for where this journey takes us. Brace yourselves— the future of insurance claims is here!