Once upon a time in a bustling city, there was an innovative tech whiz named Max who’s always on the lookout for the next big thing. One sunny afternoon, while sipping his cold-brew at a downtown café, Max stumbled upon a conversation about “asset tokenization.” His ears perked up as he overheard the term “blockchain technology for asset tokenization.” He knew this was it—the future of digital assets and investments was right in front of him. Eager to dive in, Max grabbed his laptop and began researching the wonders of tokenizing assets on the blockchain.

Read Now : “user-focused Login Authentication System”

The Boom of Asset Tokenization

Max discovered that blockchain technology for asset tokenization is like the ultimate key to a new digital financial world. Imagine owning a fraction of a luxury property in Manhattan or a piece of an iconic painting—all without having to empty your bank account. That’s the power of blockchain tech. Basically, it lets you transform real-world assets into digital tokens that you can buy, sell, and trade just like stocks, but way cooler and more accessible.

In the world of blockchain technology for asset tokenization, everyone gets to play. You don’t need to be a millionaire or a Wall Street insider to get a piece of the pie. From real estate to fine art, and even intellectual properties—everything is on the table. The best part? Transactions are transparent, secure, and super quick, giving traditional banking systems a run for their money.

This tech is like magic for investors and asset owners alike. For investors, it opens up a whole new realm of opportunities. And for asset owners, it makes liquidity a breeze. Plus, the fractional ownership aspect means scalable investment options. Long story short, blockchain technology for asset tokenization is shaking up how we think about owning and investing in assets.

Benefits of Blockchain Asset Tokenization

1. Fractional Ownership: Blockchain technology for asset tokenization allows peeps to own a slice of high-value assets without going broke. Imagine owning a chunk of a penthouse, right?

2. Increased Liquidity: Turning assets into tokens makes them easier to sell. More buyers, more money, more fun.

3. Transparency: Every transaction is logged on the blockchain, so no shady business here. It’s safe and sound.

4. Cost-Efficient: Cut out the middlemen. Less fees, more profits. Easy peasy.

5. Global Market: Assets become universal. Buy a piece of art from Paris while chilling on a beach in Bali.

Challenges in Asset Tokenization

In Max’s adventure into blockchain technology for asset tokenization, he came across a few hurdles too. Like, there’s the whole regulatory maze to tackle. Different countries, different rules. It’s like trying to play chess and checkers at the same time. Then there’s tech complexity—managing digital ledgers ain’t for the faint-hearted.

And of course, while blockchain tech is super secure, there’s always a worry about potential hacks or security breaches. Max realized that education and awareness are key here. The more common folk understand blockchain technology for asset tokenization, the more they’ll trust and use it.

But even with these challenges, Max felt it’s worth the ride. The bright prospects of democratizing investment opportunities far outweigh the bumps along the road. He’s convinced that as technology and regulations evolve, these challenges will be tackled head-on.

How Blockchain Facilitates Tokenization

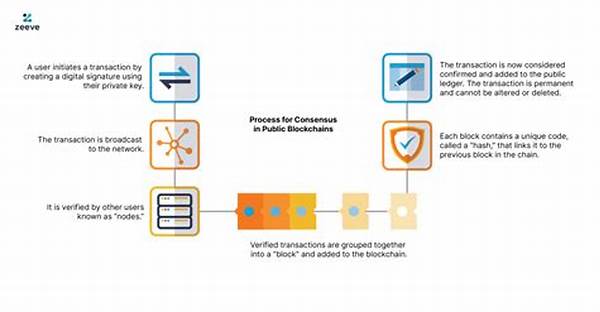

Max learned that blockchain technology for asset tokenization works its magic by ensuring that every transaction is recorded on a decentralized ledger. It’s like having a digital diary that’s immutable, so no one can mess with it. Thanks to smart contracts, the process of buying, selling, or trading tokens is automated and transparent.

Blockchain also eliminates the need for middlemen. Imagine not having to deal with tons of paperwork or high transaction fees. That part alone is enough to make Max do a happy dance. Plus, since the tokens are secured by cryptography, they’re harder to steal or forge than those old-school paper deeds.

Through blockchain technology for asset tokenization, assets become liquid. Whether it’s a vintage car or a piece of beachfront property, there’s no need for lengthy processes to convert them into cash. It’s all about speed, efficiency, and knocking down the barriers that kept regular folks out of high-value investments.

Top Use Cases for Asset Tokenization

1. Real Estate: With blockchain technology for asset tokenization, that penthouse apartment in NY can have multiple owners across the globe.

Read Now : Multi-factor Authentication Strategies

2. Art: Forget the auction houses. Buy and trade digital shares of a Picasso with ease.

3. Intellectual Property: Musicians, authors, and creators can tokenize their work and earn royalties effortlessly.

4. Collectibles: Rare comic books or vintage cars? Tokenize and share the love.

5. Commodities: Gold, silver, or oil—invest in tangible goods without the hassle of physical storage.

6. Corporate Shares: Fractionalize stocks, making them accessible to more investors.

7. Bonds: Simplify bond investments with smart contracts and instant trades.

8. Sports Contracts: Fans can invest in their favorite athlete’s future earning potential.

9. Carbon Credits: Trading eco-friendly initiatives becomes a breeze with tokenization.

10. Crowdfunding: Raise funds without the bureaucracy. Tokenization makes it simpler and more attractive to investors.

The Future of Asset Tokenization

In the end, Max’s journey into blockchain technology for asset tokenization opened his eyes to a whole new world. The potential is limitless—it’s like discovering the internet all over again, but this time, with assets. Thanks to blockchain, decentralization is no longer just a buzzword; it’s a reality that’s breaking down financial barriers everywhere.

As regulations catch up and technology continues to evolve, the road to tokenization is wide open. Max can’t wait to see how this tech shapes the next decade. Whether it’s by empowering a new generation of investors or disrupting old financial systems, blockchain technology for asset tokenization is here to stay.

Max closed his laptop with a grin. With newfound knowledge and excitement, he felt ready to be part of this digital asset revolution. He envisioned a world where anyone, regardless of financial status, could have a hand in this asset wonderland. And as he walked out of the café, he knew it was just the beginning—his own story in the world of blockchain technology for asset tokenization had just begun.