Once upon a time, in a world where people traded goods with coins and papers, emerged a new force called blockchain technology. It promised a revolution, a change so profound, that it was whispered about in tech gatherings, financial circles, and even at the family dinner table. The idea of transactions without a middleman—free from human error and tamper-proof—was thrilling. But what did it really mean? To understand, we must dive deep into the alluring, complex ocean of blockchain technology for transactions.

Read Now : Dubai Fintech Partnerships And Alliances

The New Age of Trading

Imagine a world where you no longer have to worry if your bank will process your payments on time, or if that overseas money transfer will vanish in cyberspace. Blockchain technology for transactions flips the script. It’s like turning the Wild West into a utopia. Picture your money zooming across the globe faster than you can say “confirmed.”

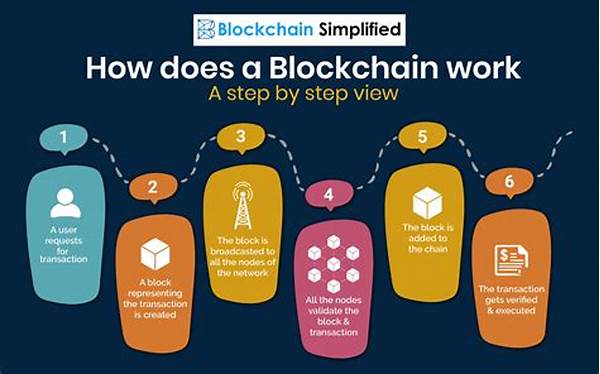

Yeah, it’s kinda like magic. But for real, every transaction is logged in a decentralized ledger—meaning, it’s not just one dude keeping track but a whole network of computers. And these “blocks” of data are chained together—a fortress of financial trust, basically. This tech does a killer job making sure transactions are fast, furious, and fraud-free.

Plus, this is all happening in a tech space that keeps leveling up like your favorite video game. Everyone from your hip startup founder to that sketchy dude selling artisanal bread at the farmer’s market is talking about making the jump to blockchain technology for transactions. Blockchain’s giving that old school financial system a serious glow-up!

Five Cool Things About Blockchain Transactions

1. Speed Demon: Transactions aren’t waiting around for bank hours—blockchain works 24/7. Your money moves super quick, like a caffeinated squirrel.

2. Trust Falls are Overrated: Trust is automatic. Every block in the chain verifies it all. Transaction transparency is clear AF.

3. Cyber Fort Knox: Security is a top-tier celeb here. Your data in blockchain technology for transactions is more locked down than a VIP afterparty.

4. No More Middleman Madness: Forget about paying extra for intermediaries. Blockchain chops off the middleman like old school mixtapes.

5. Party in Your Wallet: Craving some crypto? Blockchain makes transacting in digital coins a piece of cake. Dive into your pizza’s worth of Bitcoin!

How Blockchain is Changing the Money Game

Okay, hear this out: blockchain technology for transactions is like giving money steroids. Suddenly, everything is faster, cleaner, and ready to bench-press more than ever before. Think of blockchain as the rockstar that’s turned every financial transaction into a hit single.

People used to worry about their transactions getting lost in the banking abyss or time zone limbo. But with blockchain, it’s like having a digital personal assistant who works around the clock, never misses a beat, and makes sure everything is accounted perfectly. This tech is the unsung hero making sure your funds aren’t just loitering about but getting to where they need to go, pronto.

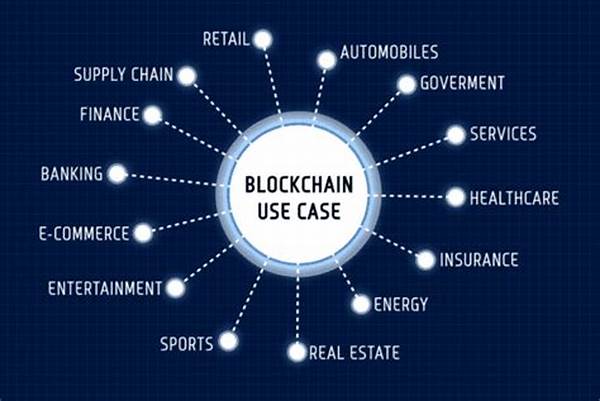

And it’s not just about the dollars or euros; blockchain technology for transactions is paving the way for all sorts of digital currencies and assets. It’s about democratizing money, making sure that anyone from the tech-savvy teenager to the grandma who just learned how to text can partake in a revolution that’s disrupting the traditional money world one block at a time.

Unpacking the Blockchain Hype

Alright, let’s get down to the nitty-gritty. Why is everyone buzzing about blockchain technology for transactions?

1. Decentralization: No big bad bank bossing you around. Just a collective keeping things kosher.

2. Security Upgrade: It’s like having your life’s savings protected by an AI ninja squad.

3. Transparency Goals: Everything’s so clear—you’ll wonder if anything else in life can hit these levels of see-through.

4. Efficiency King: Waste no time on sluggish old systems. Blockchain’s got places to be and transfers to make.

5. Cost Cutters’ Dream: Slash those extraneous fees and watch your wallet thank you.

Read Now : Enhancing Blockchain Security Through Cryptography

6. Future-Proof: As tech evolves, blockchain evolves. No outdated vibes here.

7. Innovation Booster: Count on blockchain to breed new ideas like rabbits in springtime.

8. Global Reach: You’re not just transacting locally—think globally, act blockchain.

9. Eco-friendly Touch: Digital records mean we’re showing paperless love to Mama Earth.

10. Real-Time Access: Just like scrolling through IG, your transaction deets are practically instant.

How Blockchain Builds Trust

In the world of finance, trust can be as fickle as cats. But blockchain technology for transactions builds trust directly into its framework—kinda like a trust fund, but without the drama.

Imagine knowing every detail of your transaction is locked up tighter than a vintage arcade’s high score list. Blockchain does that magic by ensuring every transaction is verified by a network of computers before it’s greenlit. This means there’s zilch chance for shady business or backdoor dealings. Just straightforward money-moving action that ensures everyone stays on their best behavior.

But it gets better, dude. Blockchain is about leveling the playing field and letting anyone become their own bank boss. You don’t need to be a financial wizard to hop on this train. Whether you’re launching an epic crowdfunding campaign or just splitting the bill at a swanky brunch, blockchain technology for transactions wraps these processes in a cozy blanket of security and efficiency.

The Rising Tide of Cryptocurrency

Just when you thought blockchain technology for transactions couldn’t one-up itself, cryptocurrency enters the chat. Cryptos like Bitcoin, Ethereum, and others are shaking up the game by letting you transact in digital moolah.

Cryptocurrency isn’t just another fancy word thrown around—in fact, it’s totally reinventing the idea of currency. It’s a whole new world where your currency of choice can fit on a thumb drive and doesn’t need any ID cards to move around. Payments, remittances, and even donations are happening at lightspeed and minus the red tape.

It’s totally baller, fam! Everybody’s invited to the blockchain party clothes optional, hype mandatory. Think of this space like the wild west days of the internet but with smarter and wiser cowboys this time. This metamorphosis is allowing fast, global transactions and unimaginable possibilities in investing and saving. With blockchain technology for transactions, it’s all about being secure, sleek, and stylish.

Wrapping It Up: Blockchain’s Wallet of Wonders

So, you’re probably getting the vibe that blockchain technology for transactions is swaggering through the world of finance like it owns the place—and you’d be right. It injects transparency, speed, security, and savvy right where they’re needed, reshaping how we handle money and cutting out the shady middleman hustle.

Picture this brave new world where your dog’s crypto jar and your retirement fund can coexist peacefully on this expansive digital ledger. It’s a win-win bonanza, folks, where every transaction happens in full view of the network but behind an impenetrable cloak of security. It’s like magic, but with fewer rabbits and more accountability.

Sure there are challenges, and like any glittering tech promise, blockchain technology for transactions has wrinkles to iron out. But hey, we’re on the cutting-edge rollercoaster ride of a revolution and it’s called FINTECH, baby! Whether you’re ready or not, blockchain’s future looks, without a doubt, like a supercharged jet ski.