Once upon a time, in the bustling world of cryptocurrencies, there was a savvy investor named Alex. With the rise of digital currencies, Alex had amassed a significant portfolio of crypto assets. However, there was a catch: his assets were sitting idle while the world kept spinning. Then, he stumbled upon the world of crypto asset loan agreements—an opportunity as shiny as a freshly mined Bitcoin. Curious and excited, Alex decided to dive right in.

Read Now : Fair Currency Exchange Policies In Gaming

The Basics of Crypto Asset Loan Agreements

So, here’s the dealio: crypto asset loan agreements are like the VIP backstage pass to the financial world for your digital coins. Hold onto your crypto, but still get some moola to play around with by using them as collateral. Imagine borrowing cash while your assets chill on a beach sipping piña coladas—it’s kinda like that. The dope part? You don’t even have to sell your prized cryptos.

In the universe of crypto asset loan agreements, some players are tight with the rules, while others are a bit more chill. You gotta find the right squad for your vibe, bro. Depending on where you park your assets, you might score some killer interest rates or, let’s be real, the not-so-pleasant ones. But hey, do your homework and you might find some treasure.

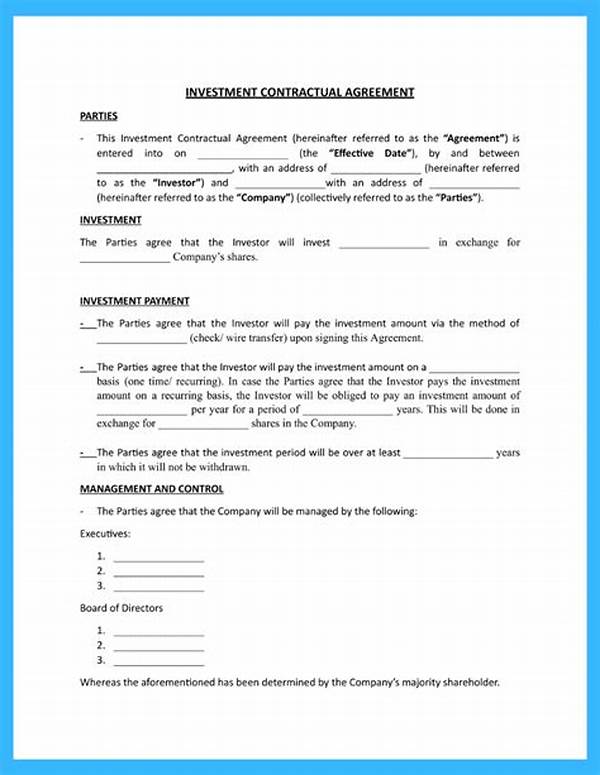

Don’t forget the golden rule: Read the small print! The crypto asset loan agreements world is no different from any hustle; it has its sharks and saviors. Know your stuff, because jumping in without a life jacket is a whole lotta nope. So, buckle up and enjoy the ride.

Why You Should Think About Crypto Asset Loan Agreements

1. Liquid Assets, Baby! Imagine having your assets paying off without saying goodbye to them. Yup, that’s what crypto asset loan agreements are all about.

2. Avoid the Tax Man: Selling could mean taxes, but with these loans, you just might keep those pesky tax li’l bugs at bay.

3. Super Speedy: Need cash like yesterday? Crypto asset loan agreements can be quicker than a hiccup.

4. Flex Those Terms: Tailor those conditions to your fit. Most agreements are flexible like yoga masters.

5. Secure the Bag: Keep your assets safe ‘n sound while they do the work for you. No need to panic like it’s a thriller movie.

Risks and Challenges in Crypto Asset Loan Agreements

Here’s the tea: diving into crypto asset loan agreements isn’t all sunshine and rainbows. Alex learned that while the potential gains were undeniably tantalizing, there were challenges lurking in the shadows. Topping the list is volatility—cryptos can swing more unpredictably than a squirrel on energy drinks. If values dip too low, the whole agreement could wobble like jelly, and liquidation might sneak in like an unwanted guest.

Moreover, regulatory waters can be murky. In Alex’s journey, navigating the maze of crypto asset loan agreements was like trying to solve a Rubik’s Cube blindfolded. Each deal and digital handshake came with its own set of rules, wrapped in layers of tech jargon. For anyone like Alex, not having a grasp on the nitty-gritty could be a steep hurdle. However, the thrill of potential profit had a way of keeping Alex—and many others—plugged into the game like crypto conquistadors.

Understanding Different Types of Crypto Asset Loan Agreements

1. Collateralized Loans: You put up your crypto as collateral, and voilà! You get a loan.

2. Non-Collateralized Loans: These bad boys involve risk—no assets to back ’em up, so lenders get creative.

3. Flash Loans: QUICK! Get a loan, use it, repay it. All in one shot—spontaneous, like a flash mob.

Read Now : Blockchain-based Ip Management Systems

4. Open-Term Loans: No end date? No worries! Keep it open, but pay your dues.

5. Secured Loans: Lock your assets, secure that loan, and strut like a peacock with your newfound numbers.

6. Variable-Rate Loans: Rates that go up and down like a roller coaster. Hold tight—enjoy the ride.

7. Fixed-Rate Loans: Like a steadfast rock amid storms, these rates won’t budge.

8. Crypto-to-Fiat Loans: Turn crypto to cash, with a swift flick of the pen—or digital equivalent.

9. Crypto-to-Crypto Loans: Swap those digital coins for other shiny ones. Diversify, diversify, diversify!

10. Peer-to-Peer Loans: Chat it up with another crypto enthusiast and strike a deal—direct connections, yo!

Crypto Asset Loan Agreements: A Growing Trend

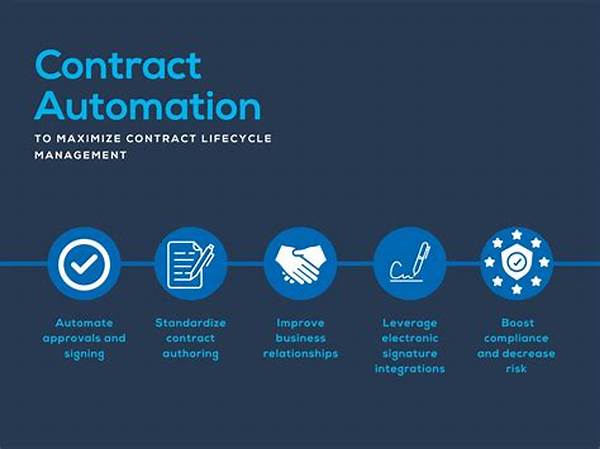

Enter the world stage where crypto asset loan agreements are the new cool kid. Alex saw the landscape shifting—not just for finance nerds in the know, but for the average Joe sipping his morning espresso. With each passing day, more people are ditching traditional banks for these decentralized moves. The appeal? Faster transactions, global opportunities, and much lower friction in that cash flow game. Move over, banks; the world of crypto lending is on fleek.

From novice investors to seasoned crypto aficionados, there is a rising chorus chanting the praises of these agreements. Alex smiled at the thought of being ahead of the curve, perhaps even a trailblazer. The future, as he saw it, brimmed with possibilities. Why cling to the old ways when technology could pave the path to prosperity? The momentum of crypto asset loan agreements was undeniable, so Alex strapped on his financial boots and stepped with swagger into this brave new world.

Summing Up Crypto Asset Loan Agreements

Alright, let’s wrap this saga with some juicy takeaways on crypto asset loan agreements. They’re a rad tool to unlock your crypto’s hidden potential while keeping your prized assets tucked in. But, there’s a maze of paperwork and intricacies to navigate. Don’t just dip your toes—cannonball in with a solid strategy, just like Alex did.

Amidst potential profits and turbulent tides, these agreements require your street smarts. Only by mastering these complexities can the benefits truly outweigh the risks. Yes, pitfalls are scattered everywhere, but for the risk-tolerant and tech-savvy, crypto asset loan agreements are a siren song too alluring to ignore. So stand tall, and with all the wisdom and care of a seasoned player, dive into this ever-evolving cryptosphere.