Once upon a digital age, in a world not so far from ours, a young tech-savvy named Jax stumbled upon a treasure chest, not filled with gold coins but rather the slick and glinting currency of the future—cryptocurrency. Jax was enamored by this digital fortune and soon realized its potential went beyond simple trading. One rainy afternoon, sipping on his cold brew, Jax discovered something that would change his financial game forever: crypto collateralized loan agreements. This revelation opened doors to leveraging his crypto assets without having to trade them away.

Read Now : Efficient Consensus Mechanisms For Storage

Unpacking Crypto Collateralized Loan Agreements

So, what’s the deal with these “crypto collateralized loan agreements”? Picture this—Jax is sitting in front of his laptop, drowning in tabs of crypto stats and memes. He doesn’t want to sell his BTC, fearing it might skyrocket in value in the near future. Then boom! He finds out he can actually borrow money using his crypto as security. That’s right, he uses those digital coins as collateral to secure a loan, and he doesn’t have to part with his precious hodlings. Essentially, it’s like having your crypto cake and eating it too.

We’re talking about an agreement where you pledge your crypto assets instead of traditional crazy paperwork. Jax was shooketh! He can get some quick cash without letting go of his digital assets. Plus, the process is streamlined—no dealing with strict bank folks or getting on the phone with nosy creditors. Jax felt like he’d unlocked a cheat code in the financial world with these crypto collateralized loan agreements.

Let’s Get Down with the Basics

1. Flexibility – You can choose how much of your crypto stash to use as collateral. Not all, just a portion.

2. Fast Cash – Loans are often processed faster than traditional routes. Jax was shook by how quickly he got his funds.

3. Freedom – You’re free to use your loan however you like—whether it’s a Lambo or the latest NFT drop.

4. No Credit Checks – Crypto collateralized loan agreements don’t rely on traditional credit scores.

5. Potential Profits – If your crypto value increases while it’s in collateral, you might make more than you borrow.

The Benefits of Using Crypto as Collateral

Jax was living in that sweet spot where he had his crypto and could leverage it too. Imagine this: while everyone else is stressing about selling their crypto for the next big investment, Jax knows he’s backed by the safety net of crypto collateralized loan agreements. It’s like having the keys to a financial kingdom where he can fund his travel adventures or bolster his crypto portfolio with the snap of his digital fingers.

These agreements give Jax the type of liquidity he always wanted without the heartache of losing out on potential crypto gains. Plus, let’s be honest, in a world that still has some trust issues with traditional banking, crypto-backed loans present an intriguing and innovative alternative. Jax thought he was just diving into the world of digital currency, but little did he know he was setting precedent for how young hustlers might bank on crypto assets in the future.

Risks Involved in Crypto Collateralized Loan Agreements

1. Market Volatility – If crypto prices drop suddenly, you might be in for a ride, pal.

2. Over-Collateralization – Some platforms might demand more collateral than traditional loans.

3. Liquidation Scenarios – If your crypto’s value dips too hard, your assets might be liquidated.

4. Interest Rates – Sometimes those interest rates aren’t as friendly as Jax’s favorite crypto meme.

Read Now : **anti-money Laundering Blockchain Solutions**

5. Regulatory Risks – Regulations can be a wild card, affecting how these agreements play out.

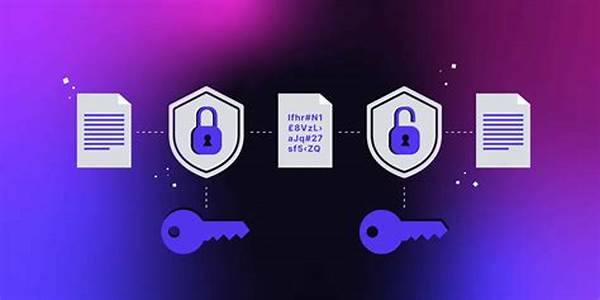

6. Security Threats – Hackers love digital gold—always double-check platform security.

7. Limited Assets – Not all crypto can be used as collateral yet.

8. Tax Implications – Get a tax pro involved to avoid unexpected taxmen surprises.

9. Platform Reliability – Not all lending platforms are created equal, do your homework, folks.

10. Inflexible Terms – Some agreements might be locked tighter than a crypto wallet.

Navigating the Crypto Loan Landscape

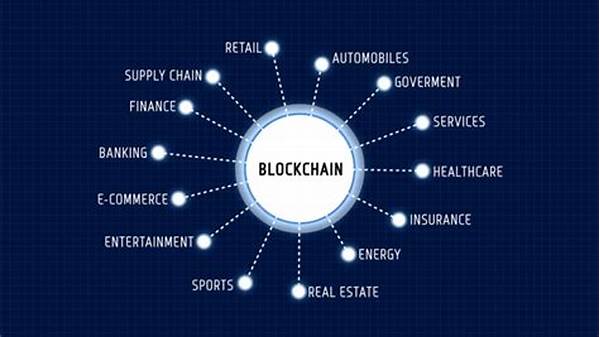

Our guy Jax got this lightbulb moment where he’s navigating the landscape of crypto collateralized loan agreements like a pro surfer catches waves. Each lending platform had its own vibe, from decentralized operations to those budding in the traditional finance meets fintech space. Jax became like a digital cowboy, weighing the pros and cons, diving into agreements with the finesse of a seasoned tech investor.

He quickly understood the importance of choosing a reliable platform—one with slick security features. After all, cybercriminals are always lurking, hoping to pounce on a misstep. So our boy, Jax, was all about doing his homework before locking in those agreements, ensuring he wasn’t about to lend his coins to some sketchy operation with a website that screamed scammer.

The Future of Crypto Collateralized Loan Agreements

As the world moves towards digital dominance, Jax sees crypto collateralized loan agreements evolving in tandem. Imagine a world where these loans not only give you freedom from traditional financial chains but also open up new avenues for income and investment. Jax, merged in this futuristic vision, knew these agreements were more than a tool—they were a lifestyle.

Looking to the horizon, Jax anticipates greater adaptation and integration of these agreements into mainstream financial ecosystems. He dreams about a day when banks and crypto meet seamlessly, granting people the power to leverage both worlds without compromise. As he continues to watch the markets, Jax feels a rising excitement—knowing he’s part of a revolution in the financial narrative, armed with his digital assets and a brave new world of opportunities.

In conclusion, this adventure with crypto collateralized loan agreements has just begun, and Jax is ready to ride the wave. He lived knowing his crypto was not just a passive investment; it was an active asset fueling his ambitions. In this digital age, adaptability, and embracing innovations like these agreements, became Jax’s competitive edge, and it could be yours too.