Once upon a digital time, Jack, a passionate crypto enthusiast, sat staring at the glowing screen in front of him. It wasn’t just a routine check of his portfolio; there was something that had been bugging him ever since he turned a nice little profit from his Bitcoin holdings. It was the looming specter of cryptocurrency taxation and reporting. Jack remembered the excitement of seeing Bitcoin’s upward climb, but now he was venturing into a world not of graphs and trends, but forms and regulations. This was about figuring out how to square those satoshis with Uncle Sam and ensuring everything he gained and lost was duly noted, filed, and, crucially, reported.

Read Now : “enhanced Compliance Using Blockchain Technology”

Understanding Cryptocurrency Taxation

Alright, so you’ve bagged some sweet gains from your crypto trades, and now the taxman’s knocking. Welcome to the world of cryptocurrency taxation and reporting. It’s like a game of chess, where you’ve gotta think a few moves ahead, or you might find yourself in checkmate with an IRS letter in your mailbox. First things first, you gotta recognize that crypto ain’t some ghostly currency floating outside the laws of finance. Nah, the IRS sees it as property, which means any gains you’ve made is like telling the tax collector, “Hey, I just got richer!” If you’ve just started trading, here’s a little spoiler: You’re about to dive deep into a world of capital gains, losses, and holding periods. Record everything, guys – every trade, every dime, just like your grandma counting coupons.

But here’s a twist – it’s not just about what you earned. Losses can save your crypto butt too! They can offset your gains, or better yet, be carried forward to future years. It’s like that “get out of jail free” card when you made that regrettable Dogecoin purchase. So, in this wild, wild west of digital dollars, being in-the-know about cryptocurrency taxation and reporting means keeping track, knowing your numbers, and maybe, just maybe, finding some tax-saving strategies to protect your hard-earned digital dosh.

Finally, never underestimate the power of good software or the expertise of a seasoned tax pro. Because you’re not just dealing with dollars, you’re dealing with codes and integrations that sometimes run deeper than a hacker’s dark alleyway. Make sure you’re using tax software that lets you easily import your trades or find a tax accountant who speaks blockchain. With the right allies in your corner, cryptocurrency taxation and reporting doesn’t have to be a tragic tale of audits and fines – it can be a smooth chapter in your crypto journey story.

Tips for Smarter Cryptocurrency Taxation and Reporting

Yo, let’s break down cryptocurrency taxation and reporting like a boss.

1. Track Your Trades: Stay on top of your transactions. Ignorance is bliss, but it’ll cost ya.

2. Know the Rules: Different countries, different guidelines. Get schooled on where you’re at.

3. Use Tax Software: Let tech be your sidekick. It’s the Robin to your Batman.

4. Offset Those Losses: Lost on some coins? Use that to your advantage during reporting.

5. Consult a Pro: When in doubt, call in the Superman of taxes – the pros.

Common Mistakes in Cryptocurrency Taxation and Reporting

Let’s spill some tea, folks. Diving into cryptocurrency taxation and reporting can be kinda tricky, and even the best of us mess up sometimes. One big slip-up? Not tracking your transactions accurately. Imagine trying to do your taxes and realizing you have no idea where half your coins went. Yeah, not cute. People also think that small transactions or those sweet freebies from an airdrop don’t count. Surprise, they do! It’s like finding out calories do count on weekends.

Another classic blunder: ignoring international tax rules. If you’re trading worldwide, you gotta know what each country expects. Do your research, or you might end up on a world tour explaining yourself. Also, let’s not even start on forgetting to report those gains. Uncle Sam doesn’t forgive and forget; he remembers every satoshi. Last but not least, always thinking you’ll remember all your trades. Newsflash, you won’t. So document everything like you’re starring in your own reality show. Cryptocurrency taxation and reporting doesn’t have to be a nightmare – just don’t sleep on the details!

Advanced Cryptocurrency Taxation and Reporting Techniques

For all you crypto mavericks, looking to up your game, here’s the cool stuff about cryptocurrency taxation and reporting.

1. Tax-Loss Harvesting: Sell those losing coins and buy them back later. Win-win!

2. Use Crypto IRAs: Tax-deferred or tax-free growth. Yes, please!

3. Crypto Staking and Tax: Know how staking rewards are taxed. Don’t let it blindside you.

4. Gifting Crypto: Give some coins, save some taxes. Share the wealth smartly.

Read Now : Big Data Applications In Supply Chain Operations

5. Offshore Accounts: Navigate cautiously, they’re a high-risk, high-reward kind of deal.

6. Like-Kind Exchanges: Pre-2018 loophole; now it’s tricky territory.

7. Optimize Holding Periods: Keep an eye on holding periods for tax-rate benefits.

8. USD Coin Trading: Utilize stablecoins to handle gains in a stable environment.

9. Constant Learning: Tax laws change; keep learning, stay ahead of the curve.

10. Blockchain Tracking Tools: Get a tool that syncs all your wallets and exchanges for a clear view.

Strategies for Effective Cryptocurrency Taxation and Reporting

Time to get strategic, guys! Cryptocurrency taxation and reporting doesn’t have to be a dreaded yearly ordeal. Get smart with your moves, and you’ll be cruising in no time. First off, keep impeccable records from Day 1. You think you’ll remember that small trade you made at 3 AM two years ago? Spoiler: you won’t. Use apps and software that help you log everything. The more automated, the better; let tech do the heavy lifting.

Think about your trades, too. Day trading might look glamorous, but for taxes? It’s a whole different ball game. If you can hold out for a year, you might have favorable long-term capital gains tax rates waiting for you. And don’t sleep on tax-loss harvesting. Offsetting those gains with losses isn’t just smart, it’s essential if you want to maximize your returns. Also, be friends with a tax pro who knows their stuff. A good accountant is like a trusty Sherpa guiding you through the tax wilderness. Plus, using a CPA with crypto expertise? That’s a power move worthy of applause.

Lastly, stay updated on tax laws, because they sure as heck will change faster than Bitcoin’s price. Follow blogs, join crypto tax forums, heck, even sign up for newsletters. Everything helps. The bottom line? When it comes to cryptocurrency taxation and reporting, be proactive, be smart, and stay informed. Less stress, more gains – that’s the goal!

The Future of Cryptocurrency Taxation and Reporting

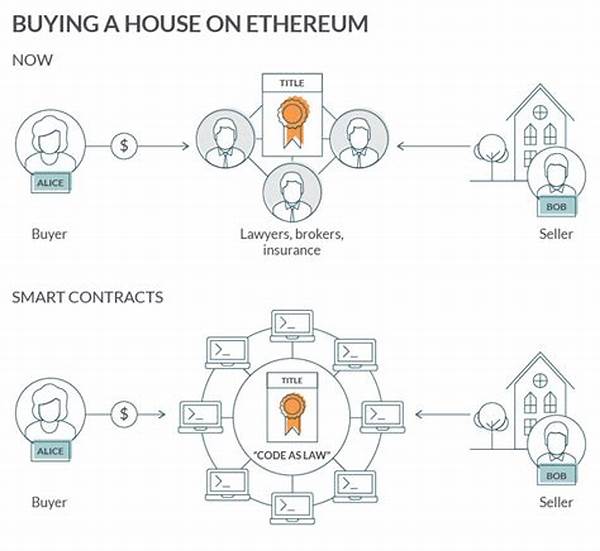

As we plunge into the digital age, the landscape of cryptocurrency taxation and reporting is bound for some radical shake-ups. Imagine a world where decentralized finance isn’t just the norm, but taxes are seamlessly integrated into your transactions. Wild, huh? Blockchain could become not just the ledger of our trades but the central hub of our tax lives. In the future, smart contracts might just auto-calculate and remit taxes as you make transactions, eliminating the tax season jitters we all know too well.

It’s also likely that digital identities will play a big role. Picture a tax ID that’s embedded in your crypto wallet. It functions seamlessly across borders, providing accurate tax obligations in real-time. The blockchain might even facilitate a universal tax system. Sounds utopian? Maybe. But that’s where things are heading. Crypto taxation teams up with AI, perhaps, making predictions and adjustments to maximize your tax efficiency. While we’re not there yet, it’s a thrilling glimpse into what’s possible if synergy, tech, and policy work together. The world of cryptocurrency taxation and reporting is evolving, and being ready for those changes is our best bet to ride the wave into future finance.

Wrapping Up on Cryptocurrency Taxation and Reporting

Phew! This journey through cryptocurrency taxation and reporting sure has been a ride, hasn’t it? We’ve explored the highs of understanding gains and losses, the little gotchas that catch even the best of us off guard, and peeked into the crystal ball of future prospects. But, if there’s one thing to take away from all this, it’s the importance of staying informed, smart, and, most importantly, chill. The terrain of cryptocurrencies is wild – prices soar, markets crash, but taxes? Man, they are the same relentless beast.

The beat doesn’t stop here though. As the world gets even more digitized and money morphs into ones and zeros, the rules of cryptocurrency taxation and reporting will keep evolving. So stick with experts, stay in-the-know, and ensure your records are as organized as your music playlists. Remember, it’s your money, you earned it, and keeping it means playing by the rules; not just the IRS’s rules, but by mastering the art and technique of taxes. Until next tax season, may your gains be large, your losses teach you lessons, and your tax reports sail smoothly into stress-free reconciliations. Peace out!