Once upon a time, in a bustling city filled with skyscrapers and neon lights, there was an insurance company trying to keep up with the fast-paced world of finance. Their mission was straightforward: make smarter, faster underwriting decisions. But achieving that goal was not as simple as it seemed. Untold data points, riveting algorithms, and the pressure to make spot-on decisions made it feel like solving an intricate puzzle. Enter technology, our unsung hero, set to transform the underwriting realm and enhance accuracy.

Read Now : “ensuring Safe Payment Gateways”

The Power of Data in Underwriting

Okay, so here’s the deal. Imagine juggling flaming balls while balancing on a tightrope. That’s pretty much what underwriting can feel like. But fear not, ’cause data is here to save the day! You see, enhancing accuracy in underwriting decisions is all about getting those solid gold nuggets of info that’re hidden in mountains of data. Dive deep into customer history, market trends, and risk assessments. It’s like being a detective, piecing together every clue to see the full picture. Harness the power of big data, and you’ll land right on target, every single time.

Alright, check this — in the underwriting world, having mad data skills means you can predict what might happen in the future. It’s like having a crystal ball, but way cooler. Enhancing accuracy in underwriting decisions not only means looking at what’s already happened but also anticipating what’s to come. Get ahead of the game, dodge the risks, and come out on top every time. With sick analysis tools, it’s a whole new level of planning!

Tech Tools That Level Up Underwriting

1. AI to the Rescue: Artificial intelligence is your new bestie. Enhancing accuracy in underwriting decisions gets a boost with this bad boy, analyzing data faster than you can say “underwrite.”

2. Machine Learning Magic: Watch the machines learn and grow, making decisions that are always on point. The key to enhancing accuracy in underwriting decisions is letting machines do their thing.

3. Robotic Automation: Skip the boring stuff. Robotic automation handles mundane tasks, freeing you up for strategic moves. Enhancing accuracy in underwriting decisions just got less tedious.

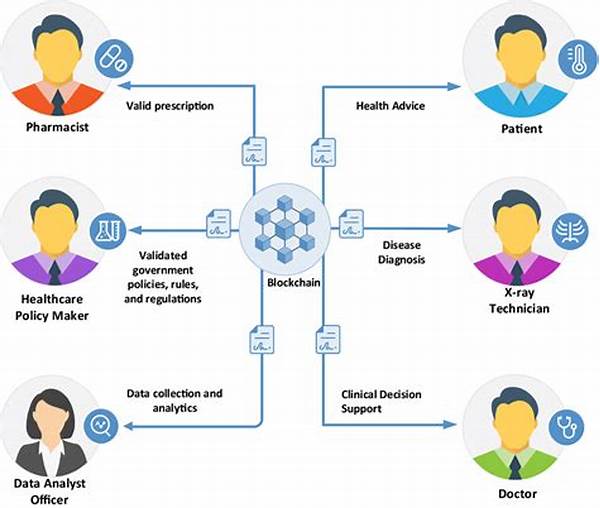

4. Blockchain Security: Keep it real with secure data transactions. Blockchain tech ensures all your underwriting decisions are made on the most credible info out there.

5. Cloud Computing Wonders: Access data from anywhere, anytime. Enhancing accuracy in underwriting decisions is a breeze when your entire team’s on the same cloud.

Training Your Underwriting Team to Be the Best

Ready to school your team? Enhancing accuracy in underwriting decisions isn’t just about tech. It’s all about the peeps, the squad, the A-team! Training is where it’s at. You gotta keep your team on the cutting edge, bringing in experts, analysts, and all kinds of savvy pros to drop knowledge bombs.

And hey, don’t forget that learning isn’t a one-time gig. It’s a marathon, not a sprint. So keep up with workshops, online classes, and hands-on pile-on experiences. Your underwriting team will be ready to handle anything thrown their way, armed with the skills to enhance accuracy in every split-second decision. They’re not just underwriters; they’re legends-in-the-making!

Read Now : Automated Device Data Verification

Game-Changing Strategies in Underwriting

Yo, so you wanna crush underwriting like a pro? Here’s how. Enhancing accuracy in underwriting decisions starts with a killer strategy:

Staying Ahead of the Curve with the Latest Trends

Trend alert! Underwriting is never static, and neither should you be. Enhancing accuracy in underwriting decisions requires staying chill with staying on top of every emerging trend out there. Get that scoop on all the fintech breakthroughs, regulatory updates, and consumer behaviors that will shake things up. Whether it’s the newest AI innovation or a change in customer perceptions, being ahead is the name of the game.

Yo, think of it like surfing—the waves of trends will come crashing in, and the best underwriters know how to ride them. Keep your fingers on the pulse, adapt quickly, and tweak your strategies as needed. Your underwriting mojo will be unstoppable!

The Future of Underwriting: What’s Next?

Looking into that crystal ball again, the future of underwriting is brimming with possibilities. Enhancing accuracy in underwriting decisions isn’t just a pipe dream; it’s becoming an everyday reality. We’re talking fully automated systems, AI-driven insights, and instant policy decisions that’ll blow your mind.

If you want to stick around in this wild world, it’s all about embracing this tech-forward future. Buckle up and get ready to explore the unchartered territories of underwriting where creativity, innovation, and precision will truly shine. The future’ gonna be epic, trust on that!

Conclusion: Wrapping It All Up

In the end, enhancing accuracy in underwriting decisions isn’t just some fancy term. It’s a mission, a goal, a journey worth taking. With a blend of data prowess, cutting-edge tech, and savvy teams, the underwriting field is set for massive transformation.

Stay sharp, get the lowdown on all you can, and more importantly, keep it real. Enhancing accuracy in underwriting decisions means adopting a forward-thinking mindset and staying agile amidst ever-evolving challenges. So, go on, put on your underwriting cape, and become the hero your clients need, solving complex puzzles with flair and pizzazz.