In a digital realm where the flick of a finger can move millions, young tech-savvy users relished the convenience of virtual transactions. With each click and swipe, money flowed seamlessly across screens, apps promised instant purchases, and midnight shopping sprees became the norm. But lurking in the shadows of this utopian digital bazaar was a growing menace: cyber threats. The thrill of digital commerce often came hand-in-hand with anxiety over security breaches. It was clear—enhancing security for virtual transactions was not just a luxury but a necessity.

Read Now : Enhanced Security In Consensus Algorithms

The Growing Need for Security

As digital transactions keep booming, the dark side isn’t lagging behind. You’ve probably heard of hackers getting smarter and slicker every day. Enhancing security for virtual transactions is the buzziest trend, but it ain’t just for show. It’s about keeping your hard-earned cash where it belongs—in your pocket and not in some hacker’s account on the other side of the world. You’d think twice before handing out your cash on the street, right? Same logic goes for your online bling, too. No one wants to wake up to a bank alert that reads “account empty” because, honestly, that’s the stuff of nightmares!

Our world’s turning digital way faster than we imagined. Online shopping, services, and even those cheeky game in-app purchases are happening a blink away. But while convenience is awesome, security’s gotta step up its game. We need robust systems that slap away intruders like a digital bouncer. Enhancing security for virtual transactions isn’t just on tech companies. It’s on us, too. Keep your passwords tight and your software right. Together, we can beat those digital crooks at their own game.

It’s a wild world online, filled with bots both friendly and mischievous. But enhancing security for virtual transactions means realizing the power is in your hands, literally. By arming yourself with knowledge and a handful of security hacks, you turn from prey to predator. Be vigilant, stay woke, and keep those transactions on lock!

Top Security Measures to Consider

1. Two-Factor Authentication (2FA): Extra layer of protection for your accounts. It’s like locking your door and then setting a booby trap. Enhancing security for virtual transactions becomes a mission impossible for intruders.

2. Encryption Tools: Convert your data into secret codes so only you can read it. Super spy stuff in your day-to-day life, leveling up your personal security game.

3. Secure Payment Gateways: Trusted platforms ensure your money isn’t playing hide and seek. It’s a safety net for when you’re buying that new gadget online.

4. Unique, Strong Passwords: Drop the “1234” password and play hard to guess. Be like, unpredictable, and keep those hackers scratching their heads.

5. Regular Software Updates: Bugs are for the birds! Always update your devices to patch up any sneaky security holes. Enhancing security for virtual transactions requires constant vigilance.

The Role of Education in Security

Knowledge is power, especially in the cyber world. Schools and workplaces are waking up, stressing the need for digital literacy. It’s not just about books anymore; it’s about knowing how not to fall for phishing scams or malware traps. Enhancing security for virtual transactions means everyone, from your grandma to your kid brother, should know the basics. It’s all about spreading the word, so everyone can surf safely in the digital sea of data.

But, let’s be real, not everyone wants to sit through a boring lecture. That’s why fun, engaging content is key. Think interactive videos, infographics, and gamified learning sessions to teach folks how to stay secure online. It’s about making learning a journey, not a chore. Enhancing security for virtual transactions through education sparks a ripple effect that secures not just individuals but entire communities.

Getting savvy about cybersecurity isn’t just geeky stuff; it’s adulting 101 in the digital age. The more people know, the more they can safeguard themselves and others. Enhancing security for virtual transactions is a collective effort. So, get your knowledge game on, and make the internet a safer place for everyone.

The Tech Behind Security

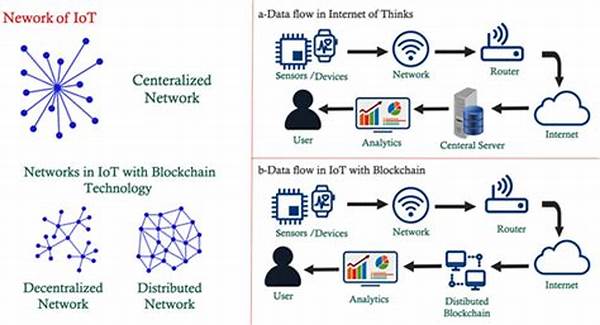

Cryptocurrencies, blockchain, AI, oh my! Tech advancements are pushing the boundaries of what’s possible with security. These bad boys can sniff out threats faster than you can say “unauthorized access.” Enhancing security for virtual transactions is no longer a dream; it’s happening now, thanks to these innovations.

Read Now : Trends In Blockchain Regulatory Frameworks

AI-powered bots patrol networks, detecting anomalies quicker than humanly possible. Blockchain offers a tamper-proof record of transactions. Meanwhile, biometrics, like fingerprint or facial recognition, lock down access tighter than a vault. It’s the future we were promised in sci-fi movies but in real life. Enhancing security for virtual transactions isn’t just about keeping up; it’s about staying ahead in a game that’s always changing.

These tech tools, combined with vigilant users, create a formidable fortress against cyber threats. But remember, while tech is cool and all, it’s only as smart as the people using it. Enhancing security for virtual transactions means humans and tech working hand in hand, forming an impenetrable alliance.

Challenges in Virtual Transaction Security

Keeping things secure in cyberspace is a never-ending hustle. New threat here, data breach there—it’s like playing whack-a-mole at the arcade. Enhancing security for virtual transactions is challenging due to the ever-shifting digital landscape, but it’s a mission everyone’s gotta be part of.

Regulations try to keep up, but they can be like sluggish internet—lagging behind the fast-paced cybercriminal world. Continuous development, adaptation, and innovation are essential to meet these threats head-on. Users, companies, and governments need to band together, share intel, and create a collaborative safeguard that’s stronger than any lone security measure.

The trickiest part? Balancing security without cramping your style. No one wants their online experiences ruined by cumbersome security steps. Enhancing security for virtual transactions involves a smooth dance between safety and usability, ensuring protection while keeping the vibe easy and seamless.

Steps to Secure Your Transactions

Click, tap, purchase—sounds easy, right? But it’s wise to take a sec to secure your digital antics. Enhancing security for virtual transactions can be as simple as learning a few key moves. Firstly, always check for the padlock symbol in your browser. That little icon means your info’s in a safe space.

Next, be a savvy checker—scrutinize your bank statements regularly. Spot anything fishy? Report it ASAP, better safe than sorry. Also, ditch the public Wi-Fi when handling anything money-related. Those open networks are like leaving your front door open.

Lastly, stay alert. Keep an eye out for phishing emails; they’re slick but be slicker. Enhancing security for virtual transactions takes a blend of common sense and basic tech know-how. Stay informed, act smart, and chill knowing your digital moolah’s got a solid shield.

Conclusion

In a world rapidly embracing digital transactions, security is more crucial than ever. Enhancing security for virtual transactions isn’t just a trend; it’s a vital practice for everyone who values their digital freedom and financial safety. By understanding and implementing the right strategies, we can navigate this digital landscape confidently and securely. Remember, with knowledge and vigilance, virtual transactions can be both convenient and safe. Let’s be smart, stay informed, and protect what’s ours in this brave new digital world.