Once upon a time in a bustling city, a young insurance adjuster named Max was sipping his coffee, staring at a mountain of paperwork. He thought about the countless stories hidden within these pages, some honest, some not so much. Fraud in insurance claims was an ever-evolving beast, and Max knew it was his job to tackle it head-on.

Read Now : Discussions From Blockchain Conference Attendees

Why Fraud Prevention in Insurance Claims Matters

Fraud in insurance claims? Yeah, it’s a big deal, like that hidden level in a video game you can never seem to beat. Every year, insurance companies lose billions – yup, billions with a “B” – to fraudulent claims. It’s not just about the money, though; it’s about trust. People need to believe insurance is their safety net, not a system to game. Fraud prevention in insurance claims ensures that trust isn’t shattered, like when your favorite character in a show betrays everyone. By putting efforts into stopping fraud, insurers can keep premiums low and maintain fairness in the industry. So yeah, fraud prevention isn’t just some buzzword; it’s the real MVP in the insurance game.

Strategies for Effective Fraud Prevention in Insurance Claims

1. Data Analytics Magic: Use data like a wizard uses spells, spotting fraud faster than a villain’s plot twist.

2. Machine Learning Heroics: Let AI do the heavy lifting, identifying patterns even the cleverest fraudster might miss.

3. Educating the People: Teach agents the art of spotting shady claims, like giving them a superhero’s x-ray vision.

4. Collab with Law Enforcement: Work together, like your fave TV duos, to bust wide-open fraudulent schemes.

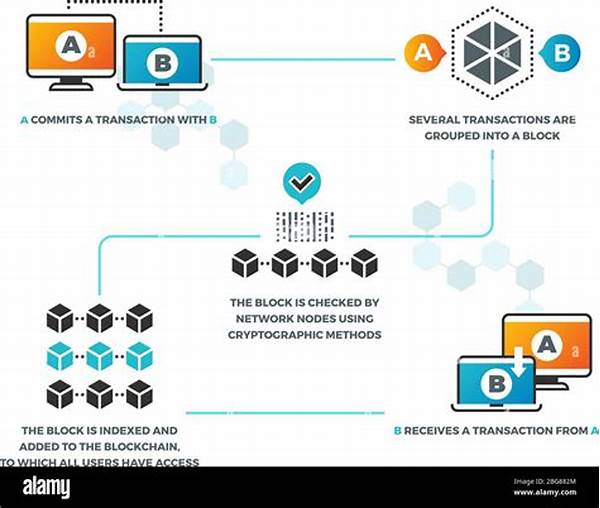

5. Secure Tech Systems: Build digital fortresses to keep fraudsters out, just like any good castle should.

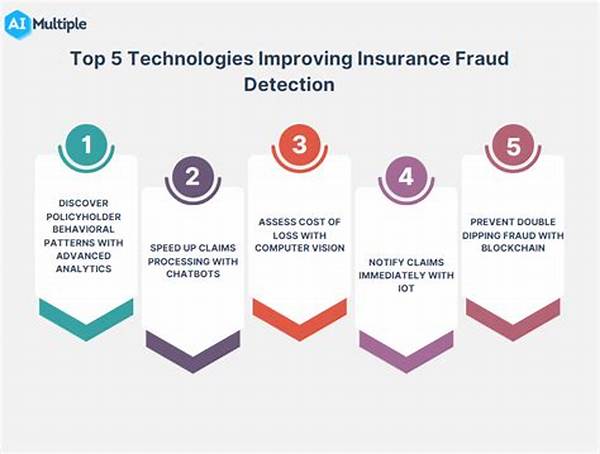

High-Tech Solutions in Fraud Prevention in Insurance Claims

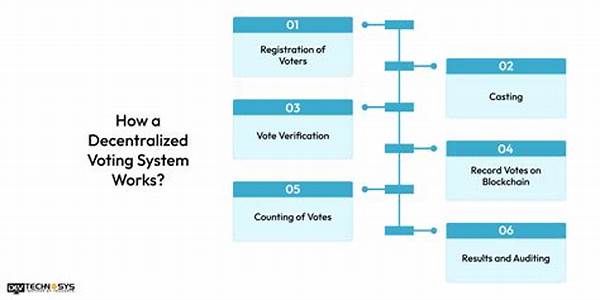

Let’s face it, fraud prevention in insurance claims is all about keeping up with those sneaky fraudsters who are always trying to stay one step ahead. Thanks to tech, the game has changed. Imagine using AI and machine learning to stand guard, acting like the ultimate security detail that never sleeps. These techy heroes help spot fishy patterns way before they become full-blown scams. Add in blockchain tech, and you’ve got a tamper-proof system that even the slickest fraudster can’t crack. Fraud prevention in insurance claims is now more like a high-octane, digital chase scene, where the good guys always stay ahead. Exciting, right?

Common Tactics Used in Fraud Prevention in Insurance Claims

1. Red Flags Galore: Spotting red flags, because like, duh, suspicious stuff is usually fishy.

2. Interviews That Matter: Chatting up the claimant to get the inside scoop – trust the vibes.

3. Document get lowdown: Peeping those docs for anything the least bit sketchy.

4. Surveillance Shenanigans: Sometimes you gotta keep an eye out to catch those fibbers.

5. Scoring Systems: Like your fave video game, scoring systems rank claims by scam potential.

Read Now : Connecting Iot Devices In Logistics

6. Behavioral Analysis: Study claimants like a mystery novel to figure out who’s fibbing.

7. Collaborating with the Pros: Team up with fraud experts to keep the fraudsters in check.

8. Policy Audits: Regularly checking policy terms to ensure no loopholes exist.

9. Digital Fingerprints: Use tech to track digital footprints, catching fraudsters with their hands in the cookie jar.

10. Training Camps: Keep skills sharp by regularly training staff on new fraud prevention techniques.

The Role of Whistleblowers in Fraud Prevention in Insurance Claims

Whistleblowers are the unsung heroes in the world of fraud prevention in insurance claims. Think of them as the tipsters, the insiders who aren’t afraid to drop the dime on shady ops. They’re the ones who know the underbelly of the beast and aren’t scared to call it out. Thanks to them, fraudsters don’t get to walk away with a plush payout. By stepping up and saying, “Hey, this ain’t right,” whistleblowers help keep the system honest and secure. And yes, sometimes they even get rewarded for their bravery. In the world of insurance claims, whistleblowers are like that unexpected ally who saves the day. Talk about being clutch.

Building a Culture of Integrity for Fraud Prevention in Insurance Claims

Building a culture of integrity in the insurance world? It’s all about setting up a vibe where honesty isn’t just expected – it’s celebrated. Get everyone in on it, from the top brass to the newbies. Make fraud prevention in insurance claims the talk of the town. Host workshops, training sessions, and keep everyone clued up on the latest tricks and tech. Celebrate those who step up, spot scams, and call out shady dealings. It’s like throwing confetti for honesty, making sure everyone knows fraudsters aren’t welcome here. Create an environment where transparency is the name of the game, and fraud prevention isn’t just a duty – it’s a way of life. And let me tell you, it makes all the difference.

Final Thoughts on Fraud Prevention in Insurance Claims

In the end, fraud prevention in insurance claims is all about keeping things fair and square. Sure, some days it feels like chasing shadows, always staying on high alert for the next fraudster-in-the-making. But here’s the deal: every time fraud is nipped in the bud, it’s a win for everyone playing by the rules. It’s all about creating a level playing field where scams don’t get a moment to breathe. So, whether you’re on the front lines or supporting the squad, know that every effort in fraud prevention counts. Together, we weave a net of security, cutting off fraudsters at every corner, ensuring insurance does what it’s supposed to do – get folks back on their feet without a hitch.

And there you go, a little glimpse into the ever-buzzing world of fraud prevention in insurance claims. Because real talk, trust and fairness in this space? It’s pure gold.