What Are Peer-to-Peer Insurance Systems?

Picture this: A cozy café at the corner of Maple Street. In the center of the buzz, three old pals are huddled over steaming coffees, discussing the latest buzz—peer-to-peer insurance systems. It’s the hottest trend, and everyone’s talking about it like it’s the coolest secret in town. Lisa, the savvy one, drops the bombshell about this new way of insurance that’s shaking up the old-school industry. Mike, ever the curious one, is all ears, while Jake is just amazed at how everything is going digital—even insurance! Peer-to-peer insurance systems, they learn, is all about people coming together to support each other with their insurance needs, cutting out the big corporations in between. It’s like a community pooling its funds, and it’s revolutionizing how insurance works. Intrigued yet?

Read Now : Distributed Network Performance Improvement

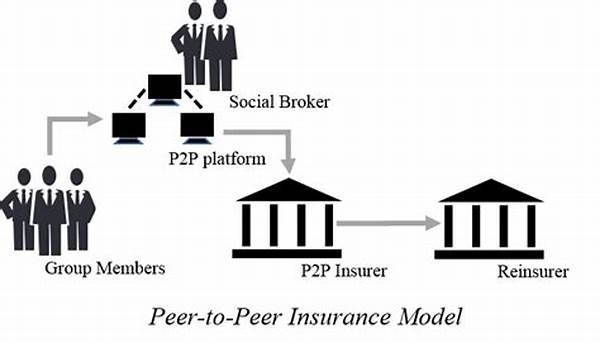

The Mechanics Behind Peer-to-Peer Insurance Systems

1. Pool Party: Think of it as a big bowl where all your pals pitch in a bit of cash for a rainy day fund. This mutual trust is the core of peer-to-peer insurance systems.

2. Transparency Rules: With peer-to-peer insurance systems, everything’s upfront—no sneaky fine print. When claims are made, members see where their money’s going.

3. Cutting Out the Middleman: It’s all about trust and community, eliminating that middle guy who’s taking a chunk (ahem, insurance companies).

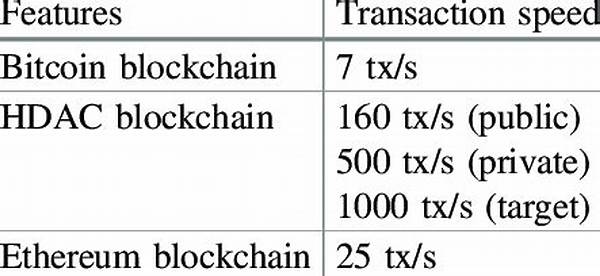

4. Tech-Savvy Soul: Powered by latest tech, these systems make managing insurance easy-peasy, all from your smartphone.

5. Quick Payouts: No more waiting eons for a claim. These systems promise faster, more efficient payouts.

Why Are Peer-to-Peer Insurance Systems So Popular?

In a world craving genuine connections, peer-to-peer insurance systems hit the sweet spot. They bring back a sense of community and trust in a realm that’s grown too corporate. Many folks feel like a cog in the wheel when dealing with traditional insurance. But here, every voice counts. Plus, let’s not forget the cool tech that’s backing this system. Fancy apps and online platforms mean you get everything done at the tap of a finger. Peer-to-peer insurance systems are turning heads, making insurance feel fresh and approachable.

The allure lies in the shared goals. It’s not just about profit but also about mutual support. And in today’s age, where everything feels impersonal, this touch of camaraderie is a game-changer. People get to have a say in the claims process, see the transparency in action, and join a support system that feels personal. It’s like having a secret club, but one that genuinely has your back.

The Benefits of Embracing Peer-to-Peer Insurance Systems

1. Community Vibes: With peer-to-peer insurance systems, you’re part of a tribe that’s got each other’s backs.

2. Cheaper Premiums: Cutting out middlemen means potentially lower costs for everyone.

3. Mutual Goals: It’s not just about you, but about helping the whole group thrive.

4. Empowerment: Giving power to the people with transparency and accessibility like never before.

5. More Control: Members really get to know where their money’s going.

6. Rapid Growth: It’s a fast-evolving space, driven by tech advances and community engagement.

Read Now : Improving Blockchain Data Storage Systems

7. Less Bureaucracy: No one’s got time for red tape. Claims are straightforward and simple.

8. Flexibility: Peer-to-peer insurance systems can adjust to changing needs swiftly.

9. Feeling Valued: Individuals aren’t just policy numbers but are part of a bigger mission.

10. The Trend Factor: It’s riding the wave of digital transformation, making insurance feel less like a chore and more cool.

Challenges Facing Peer-to-Peer Insurance Systems

While peer-to-peer insurance systems are riding high, they’re not without hurdles. Like, not everyone’s ready to hop onto this new wave. Skepticism abounds when it comes to something so radically different. There are legal hurdles, too, not to mention the challenge of building a trust-worthy community from scratch. Security concerns? Definitely, in this digital age, those are top of mind. But, as it often happens with disruptions, change takes time and a shift in mindset.

Yet, the positive vibes are undeniable. Peer-to-peer insurance systems signal a future where insurance feels like a friend rather than a foe. It’s all about creating that authentic connection in an age where that’s hard to come by. So while there are challenges, there’s also immense potential for those willing to brave the new world.

The Future of Peer-to-Peer Insurance Systems

As more people embrace peer-to-peer insurance systems, who knows what innovations lie ahead? Imagine integrations with AI that make insurance even smarter. Or how about systems that learn from your lifestyle to offer personalized premiums? The possibilities are endless when tech meets community.

The journey’s only just begun, and those who’ve tasted this new way aren’t looking back. For them, peer-to-peer insurance systems aren’t just a fad—they signify a revolution. It’s an exciting space, with room to grow and evolve. And if you keep an eye out, you might just spot some mind-blowing changes that redefine how we think of insurance.

In Summary: Why Consider Peer-to-Peer Insurance Systems?

In a nutshell, peer-to-peer insurance systems are about friends helping friends—not just faceless transactions. It’s a fresh spin in insurance, and it’s shaking things up in the best way. It brings people together, puts us back in control, and flips the script on what insurance means today.

So whether you’re a curious cat or a tech enthusiast, diving into the world of peer-to-peer insurance systems could be your next big thing. With community at its core and powered by snazzy tech, it might just change your views on insurance forever. It’s not just a trend; it’s a movement. And hey, being part of a movement—that’s what being ahead of the curve is all about, right?