Once upon a time, in the bustling digital realm, where finance and technology danced a complex tango, a revolutionary innovation stepped onto the stage: smart contracts. Imagine this world where every transaction, every deal, was sealed with the unbreakable code. It was like having a virtual superhero ensuring that promises were kept, and chaos kept at bay. These smart contracts weren’t just flashy newcomers; they were here to revolutionize risk management.

Read Now : Bridging Logistical Inefficiencies Techniques

The Magic of Smart Contracts in Reducing Risk

Picture this: you’re in the fast-paced world of business, where every decision could lead to triumph or catastrophe. Enter smart contracts for risk management. These digital marvels are like having a trustworthy friend who’s always got your back. They automatically execute transactions and verify agreements, minimizing human error and ensuring transparency. You’re no longer lost in the labyrinth of paperwork and legal jargon.

With smart contracts for risk management, it’s like having a crystal ball that shows you all possible outcomes. You know exactly what to expect and can plan accordingly. This tech-savvy wizardry ensures that all parties involved stick to their word, reducing risks associated with fraud or delays. No more sleepless nights worrying about contract breaches or unscrupulous partners. It’s all about peace of mind, and that’s priceless, right?

But wait, there’s more! Smart contracts for risk management aren’t just about minimizing the bad stuff—they’re about maximizing the good. They streamline operations and slay inefficiencies. You’re looking at quicker, more efficient processes that save time and money. Who wouldn’t want a piece of that action? It’s the future of risk management, and it’s here to stay.

How Smart Contracts are Changing the Game

1. Automation Galore: Smart contracts for risk management automate everything, reducing the need for a middleman. Less human error, more efficiency. It’s like having a digital assistant that never sleeps.

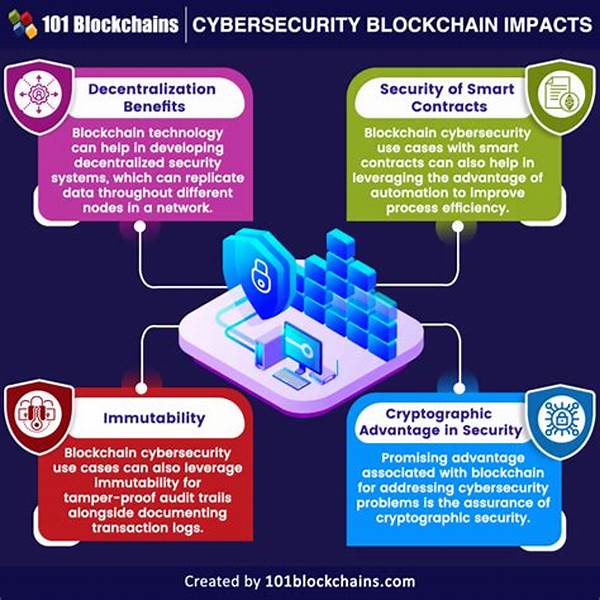

2. Transparent Transactions: Every transaction is recorded on a blockchain, leaving an immutable trail. No more sneaky business; everything’s crystal clear.

3. Cost-Effectiveness: Say goodbye to excessive legal fees and paperwork. Smart contracts streamline operations, saving time and money.

4. Faster Execution: With predefined terms, agreements execute themselves in real-time. No more waiting on human approval; it’s a fast lane to success.

5. Enhanced Security: By nature, smart contracts are secure and tamper-proof. They’re the Fort Knox of digital agreements!

Smart Contracts and the Future of Risk Management

Fast forward a few years, and the word on the street is that smart contracts are the backbone of the business world. The old ways of doing things? Consider them obsolete. Companies big and small have jumped on the bandwagon, realizing that smart contracts for risk management are the ultimate game-changer. It’s not just about tech-savvy startups; even the traditional giants are embracing this digital revolution.

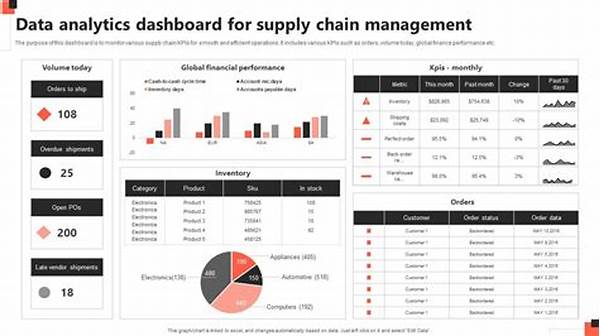

Imagine a world where insurance claims are processed in seconds, or supply chains operate with precision without a glitch. That’s the magic of smart contracts for risk management. This tech is not just a tool; it’s an entire ecosystem, working tirelessly in the background, ensuring everything runs smoothly. Talk about a knight in shining armor for modern businesses!

The ripple effect is undeniable. Industries across the board—from finance to healthcare—are reaping the benefits. The world might be unpredictable, but with smart contracts for risk management, there’s a safety net ensuring nothing falls through the cracks. It’s not just the future; it’s happening now, and it’s creating waves.

From Buzzword to Business Essential: Smart Contracts

As the saying goes, “If you can’t beat ’em, join ’em!” Businesses worldwide are doing just that, seeing the immense value in smart contracts for risk management. Let’s break it down:

1. Reliable and Self-Executing: These contracts define rules and penalties just like traditional contracts, but they also enforce obligations automatically.

2. Flexibility Across Industries: From real estate to entertainment, smart contracts adapt, providing customized solutions wherever needed.

3. Mitigating Fraud Risks: The transparency and traceability of blockchain mean fewer opportunities for foul play. Authenticity is now guaranteed.

Read Now : Intellectual Property Tokenization Innovation

4. Decentralized Confidence: Free from third-party influence, smart contracts offer impartiality that ensures fairness for all involved.

5. Aligning Incentives: Everyone’s on the same page, with transparent goals and outcomes. No more hidden tactics—just clear agreements.

6. Trustless System: You don’t need to “trust” anymore; the technology does the heavy lifting.

7. Environmentally Conscious: Digital processes mean less paper waste. Save trees while saving money and time!

8. Scalability: Works for any business size—from a small startup to a Fortune 500 company.

9. Seamless Integration: Easily slots into existing systems, ensuring a smooth transition to a more efficient way of operating.

10. Future-Proof: As technology evolves, smart contracts are agile enough to adapt and grow with your needs.

Embracing the Revolution: The Road Ahead

For those still skeptical, it’s time to open your eyes to the revolution unfolding around us. Smart contracts for risk management are not just buzzwords thrown around in tech circles. They’re powerful tools reshaping the way we do business. The transition might seem daunting, but the rewards? Absolutely worth it.

Sure, there are challenges ahead—technology always comes with a learning curve. But the businesses embracing smart contracts today are already seeing the benefits stack up like their favorite crypto investments. Staying ahead in today’s world means evolving with the times, and there’s no better evolution than smart contracts for efficient risk management.

The truth is, we’re just scratching the surface. There’s an entire universe of possibilities waiting to be unlocked. Whether you’re a small business or a global corporation, smart contracts are the gateway to a seamless, risk-managed future. Bet on this tech, and you’re not just betting on security and efficiency but on innovation that stands the test of time.

Wrapping Up: Smart Contracts for Risk Management

To sum it all up, smart contracts for risk management are more than just a phase—they’re the future. This isn’t merely about surviving but thriving in a world full of uncertainties. It’s like having a safety net woven with code and promise—a digital ally eager to reduce risk and enhance transparency.

From automation to enhanced security, smart contracts are changing how we negotiate risk, saving not just time but valuable resources and sanity, too. Their adaptability across industries only underscores their importance. This isn’t just tech; it’s an advancement in how business gets done.

And remember, the best part of all this? It’s only getting better with time. The digital frontier is vast, and with smart contracts leading the charge, companies can look forward to a future that’s not just safer, but smarter, too. So here’s to the excitement of what’s to come and the digital revolution that’s already here—smart contracts for risk management are setting the new standard.