Once upon a time in the bustling city of Metropolis, there was a girl named Jenny who had an unfortunate habit of attracting trouble. With her car recently transformed into modern art by a runaway shopping cart, Jenny found herself embroiled in the confusing world of insurance claims. Like many, she faced a labyrinth of opaque policies and cryptic procedures. But unbeknownst to Jenny, change was brewing. The era of streamlining insurance claim transparency was dawning, promising clarity and peace of mind to all who dared to navigate the daunting claims process.

Read Now : Regulatory Compliance For Tokenized Securities

Simplifying the Maze

Alright, let’s break it down, peeps. We know insurance claims can be messier than a three-year-old with a bowl of spaghetti. You’re stressing, sweating bullets, and wondering if you need a PhD to unravel the mystery of clauses and premiums. That’s where streamlining insurance claim transparency plays savior. Think of it as your superhero for demystifying the jargon jungle. It’s like switching your old-school flip phone for the latest smartphone. Everything becomes easier, clearer, and way less drama, so you can chill and let your insurance do its thing without the headache.

Why It Matters

1. Clarity First: No more guessing games? Yes, please! Streamlining insurance claim transparency ensures you understand what’s covered and what’s not—no more awkward surprises.

2. Time Saver: Let’s be real, no one has time to be stuck on hold forever. This process speeds things up, like adding nitro to your daily grind.

3. Peace of Mind: Stress levels dropping means happier days. Knowing exactly where you stand makes a world of difference.

4. Trust Building: When things are clear and out in the open, trust just naturally blooms. It’s like a solid friendship for your finances.

5. Improved Relationships: Smooth claims lead to happier customers and insurance companies. Everybody wins!

The Digital Revolution

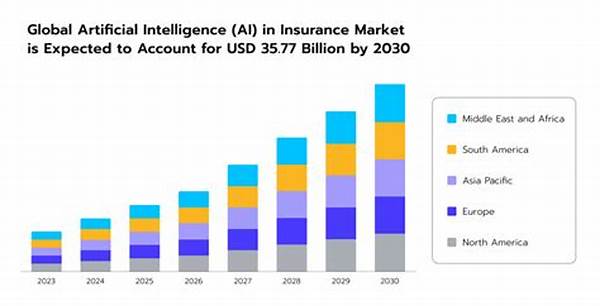

Streamlining insurance claim transparency is like jumping on a rocket to the future where digital is everything. Think AI, apps, and online portals that cut through the red tape. Picture this: Jenny no longer spends weeks sending paper forms back and forth. Instead, she uploads a couple of slick photos of the damage into an app and gets real-time updates. The benefits don’t stop there. It’s a full-on revolution, with companies adopting technology faster than you can say “innovation.” Say goodbye to the waiting game and hello to convenience!

The Role of Technology

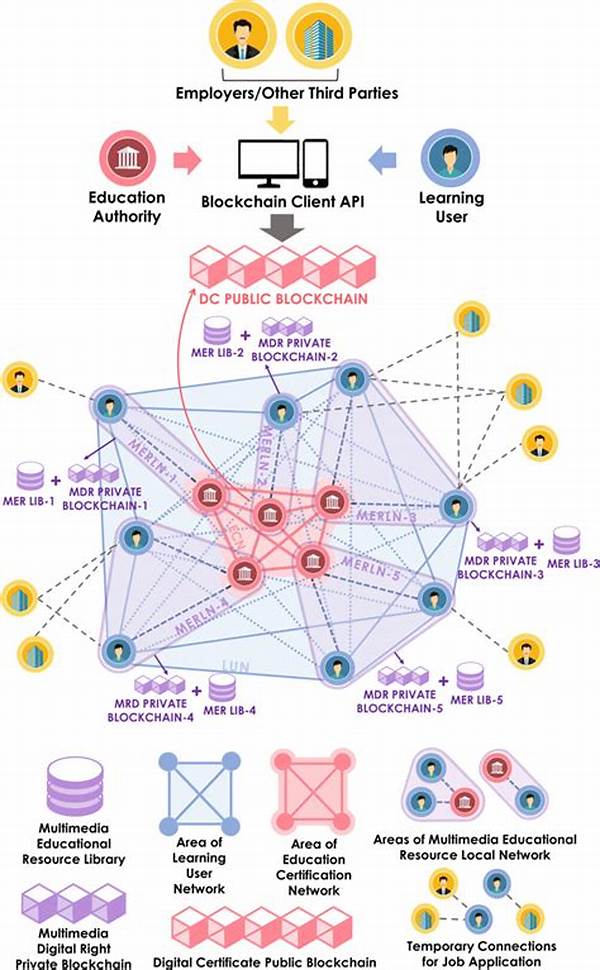

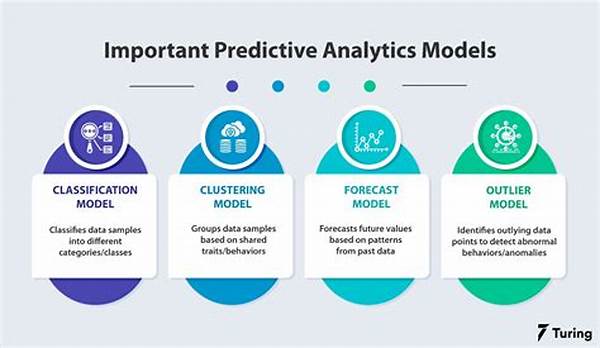

Technology is the ultimate game-changer in streamlining insurance claim transparency. How? Imagine all those complicated steps you dreaded? Poof! They vanish, thanks to automation. We’re talking about straight-up wizardry that handles everything from document verification to communication. Whether it’s a chatbot guiding you or an AI sorting out your paperwork, tech is the superstar of this story. It’s like having a digital sidekick that’s always got your back, so you can focus on what really matters.

1. Automation Rocks: Let’s ditch the manual and kick back as tech takes over the routine stuff.

2. Data Sync: Real-time updates keep everybody on the same page. Less confusion, more action.

3. Ease of Access: At-home or on-the-go, your claims info is right there in your pocket.

4. Enhanced Security: Say goodbye to file cabinet chaos. Encryption keeps your info safe and sound.

5. User Interface: Sleek and easy-to-navigate designs make life breezy.

6. 24/7 Assistance: Help is available whenever you need it—just like that drive-thru snack run.

Read Now : Instant Logistics Performance Feedback

7. Custom Solutions: Tailored services spot on for unique needs. No more one-size-fits-all.

8. Feedback Loops: Keep growing and improving as feedback rolls in and makes processes better by the nanosecond.

9. Eco Friendly: Less paper, more green—love your planet while taking care of business.

10. Game-Changing Experience: Once you transition, there’s no going back. It’s too good!

Making the Switch

Embarking on the journey of streamlining insurance claim transparency may feel like swapping your bike’s training wheels for a shiny new hoverboard, but trust us—it’s worth it. Imagine every tedious step of your past insurance escapades magically disappearing into thin air. Once your insurance provider hops on this bandwagon, you’ll speed through those claims like a pro.

Transitioning isn’t a leap into the unknown; rather, it’s like entering a theme park where every ride is tailored to your taste. Suddenly, filing a claim isn’t the beginning of a long, dreary road trip, but an express lane to action and resolution. With insurance companies adopting these streamlining practices, you’ll find claims almost resolving themselves, while you sit back and relax, binging your favorite series.

Embracing the Change

It’s time to bid farewell to the old ways and welcome the exciting, new world of streamlined insurance claim transparency. It’s like trading your regular morning coffee for a double shot of espresso – you feel energized and ready to take on the world. Sure, the old way was cozy, like your favorite grandma’s home-cooked meal, but the new way is like dining at a five-star restaurant. It’s all about embracing change, stepping up, and finding power in clarity.

Jenny’s story isn’t one-off; it’s the collective narrative of every policyholder ready for a breath of fresh air. Transitioning to a more transparent system means those who felt frustrated and powerless in the face of complex insurance processes now feel informed and in control. It’s no longer just about policy and process; it’s about trust, efficiency, and the confidence to navigate life’s ups and downs knowing your insurance has got you covered.

Through this journey of streamlining insurance claim transparency, Jenny found peace knowing her world didn’t have to revolve around confusing claims. She gained clarity and, along the way, inspired others to jump aboard the transparency train. So, ready to dive into a world where insurance claims are no longer a tedious obligation but a seamless, transparent affair?

Wrapping It Up

In conclusion, streamlining insurance claim transparency is the game-changer we didn’t know we desperately needed. Give those opaque systems the boot and opt for something that puts you in the driver’s seat rather than feeling like you’re stuck in the passenger seat, thumbing through endless paperwork. It’s a call to arms for the finicky and the frustrated – time to shake hands with technology, clarity, and a more efficient future.

For Jenny, and for countless others teeing up at the threshold of this revolutionary shift, streamlining insurance claim transparency has transformed a dreaded chore into something that empowers them, all while saving time and reducing stress. By embracing this change, you’re not just stepping into a new era of insurance; you’re jumping into a pool of innovation where trust and transparency reign supreme. Welcome to a new dawn in insurance where claims are clearer, faster, and totally made for you.