Once upon a time in the bustling city of Metropolis, lived a young chap named Alex, who was as confused about insurance claims as a cat on a hot tin roof. Every time something went sideways, from fender benders to storm damages, Alex broke into a cold sweat just thinking of navigating the monstrous labyrinth of insurance discussions. That was until he stumbled upon the magical words—transparent insurance claims procedures. This not only became a game changer for him but also a beacon of hope for his community.

Read Now : Dubai Financial Technology Networking

Why Transparent Insurance Claims Procedures Matter

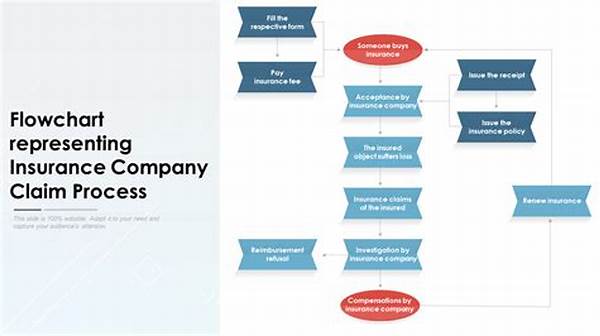

Gone are the days when dealing with insurance companies felt like pulling teeth. Imagine having a process where you see everything, know every step, and can predict the outcomes! Transparent insurance claims procedures are like the GPS for your insurance journey. Instead of driving blind, you’ve got real-time updates!

It’s like you’re sitting at your favorite coffee shop, and someone hands you a map of every insurance pitfall you might encounter. With this kind of clarity, it’s easier to make informed decisions, know where your claim stands, and focus your energy on more rewarding activities—like debating if pineapple belongs on pizza. The days of playing hide and seek with your insurance claims? Totally over, dude.

In a world where everything’s hustling at light speed, having transparent insurance claims procedures is low-key essential. It keeps you in the loop and spares you the jaw-drop surprises of hidden fees and conditions. With transparency, you’re not just another name in the system; you’re a partner in the process.

Advantages of Efficient Claims Procedures

1. Clear Communication: Like chatting over a cup of joe, every detail is shared openly.

2. Speedy Resolutions: Feels like fast-forwarding through the boring parts right to the climax.

3. Less Stress: No more anxiety, just soothing vibes knowing where your claim stands.

4. Trust Building: Kinda like building a solid bond with a new friend, it’s all about trust.

5. Informed Decisions: You’re not in the dark; you get to call the shots with all the info you need.

What Makes a Process Transparent?

Transparent insurance claims procedures aren’t just a fancy term. They mean giving you the 411 on what’s happening with your claim. First off, updating you at every stage, from “we got your claim” to “here’s your payment” is crucial. It’s like that friend who texts you updates during a concert when you can’t make it. Super thoughtful, right?

Moreover, transparency involves breaking down complex jargon into something you’d actually understand. No one wants to feel like they’re in a foreign film without subtitles. These procedures ensure that you’re on the same page as your insurance provider, maintaining clarity and avoiding the dreaded finger-pointing scenarios.

Essential Features of Transparent Claims Processes

1. No Hidden Fees: Just like honesty is the best policy, no sneaky costs here.

2. Real-time Updates: It’s like having your favorite app notifications on to keep you posted.

3. Accessibility: Everything’s as reachable as your phone in your back pocket.

4. User-friendly Language: Ever wished insurance talk sounded like talking to your buds? Wish granted.

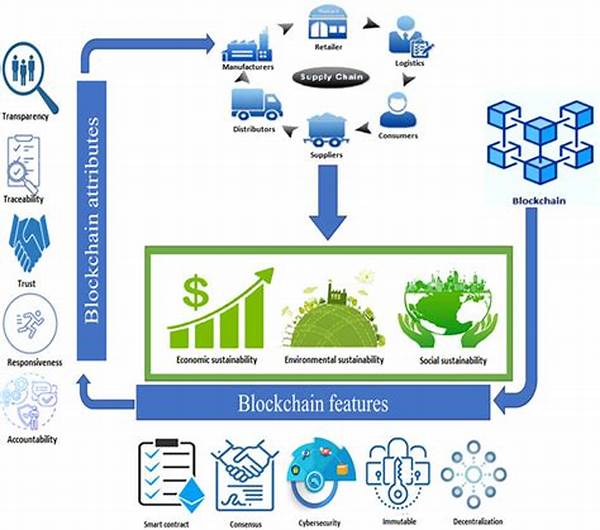

Read Now : Blockchain For Sustainable Development Goals

5. Predictable Timelines: Planning your next move won’t feel like betting games.

6. Easy Dispute Resolution: Problems? Bam! Sorted faster than your playlist.

7. Guidance at Every Step: Need a buddy to walk you through? This process has your back.

8. Customer-Centric Approach: You’re the star of the show. The whole process rotates around you.

9. Consistent Tracking: Keeps you updated like your favorite vloggers.

10. Efficient Documentation: It’s like snapping selfies and uploading on cloud storage—secure and straightforward.

The Role of Technology in Transparency

Tech is the DJ remixing the insurance industry’s track, making it groovier. With apps and online portals, transparent insurance claims procedures walk with you everywhere. It’s like carrying an entire world in your pocket where you can track claims, check statuses, and get alerts in real-time.

With tech, it’s not just about fancy apps; it’s about dialogue. Chatbots are the new pals answering questions at 2 AM when the ‘rents are asleep, and you’re up worrying. Having this level of access and transparency makes the insurance process feel less like a chore and more like picking your fav-tune playlist.

Wrap-up: Keeping it Chill with Transparency

In the grand scheme of things, those transparent insurance claims procedures are about maintaining your zen. Having an understanding, feeling part of the process, and being able to plan ahead takes a massive load off your shoulders. And let’s be real—life’s tough enough without the extra baggage.

Alex, our savvy Metropolis dweller, became the poster child of this new transparent era. No more deciphering complex claims processes or fearing the elusive payout. Like Alex, why shouldn’t we all have a seamless experience? Transparency in our insurance dealings is not just a nice-to-have; it’s a must-have, turning insurance folklore from horror stories into fairy tales.

By empowering us with clearer procedures, we can focus on what truly matters—living life to the fullest and pizza debates. Embrace the transparent insurance claims procedures and watch as insurance evolves from a gray area into a technicolor adventure.