Once upon a time in the bustling world of online shopping and digital payments, there lived ordinary folks who trusted the convenience of virtual transactions. Little did they know, lurking in the dark corners of the internet were cunning fraudsters, ready to pounce on unsuspecting victims. Our story will delve into how we, the digital citizens of today, can outsmart these digital tricksters through effective virtual transaction fraud prevention.

Read Now : Transaction Optimization In Distributed Systems

Why Virtual Transaction Fraud Prevention Matters

Yo, guys! Let’s talk about why virtual transaction fraud prevention is a big friggin’ deal. Imagine your hard-earned cash disappearing into thin air because some sneaky fraudster figured out a way to trick you. Scary, right? Exactly! This is why you gotta be on top of your game. Virtual transaction fraud prevention isn’t just about keeping your money safe, but also about peace of mind when you shop online or move money digitally. With the rise of online transactions, fraud has gotten more sophisticated. That means we gotta stay sharp, know the tricks of the trade, and keep these fraudsters at bay. It’s like having a superhero power, but instead of saving the world, you’re saving your cash!

Key Strategies for Preventing Fraud

1. Two-Factor Authentication (2FA): Get that extra layer of security by using 2FA. It’s like adding another lock on your door to keep crooks out. Virtual transaction fraud prevention at its best!

2. Use Strong Passwords: Ditch the “123456” or “password.” Be creative! Mix letters, numbers, and symbols to give fraudsters a headache.

3. Secure Your Network: Online shopping is fun, but make sure you’re on a secure network. Public Wi-Fi is a big no-no. It’s like handing fraudsters a free pass.

4. Regularly Monitor Accounts: Keep an eye on your bank and transaction statements. The earlier you spot something fishy, the better.

5. Educate Yourself: Knowledge is power, folks! Stay updated on the latest scams and methods for virtual transaction fraud prevention.

Spotting the Frauds Early

Alright, let’s get real. Spotting fraud early is kinda like having a superpower. It’s all about paying attention to the tiny details that shout “SCAM!” Yeah, that dodgy email you got? Don’t click on any links, dude. They’re full of bad news. And those super-duper deals that seem too good to be true? They usually are. Virtual transaction fraud prevention starts with using your gut and a good sprinkle of common sense. Don’t ignore your gut feeling, and double-check before you proceed. This diligence will save you a whole lotta trouble in the long run.

Read Now : Big Data Applications In Supply Chain Operations

The Role of Technology in Fighting Fraud

Now, onto the fun stuff – technology! From AI to machine learning, these tech wonders are doing wonders in virtual transaction fraud prevention. Picture this: AI is like your digital guard dog, sniffing out anomalies and barking at fraudulent sniffers. It can analyze patterns and behaviors like a boss, flagging suspicious activity before it wreaks havoc. Machine learning, on the other hand, keeps on learning and adapting, getting better each day at spotting fraudsters and their sneaky tactics. So yeah, embrace the tech revolution, folks. It’s a game-changer!

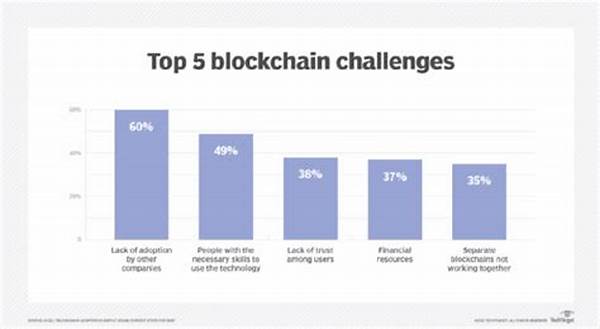

Challenges in Virtual Transaction Fraud Prevention

But hey, it ain’t all smooth sailing. Challenges? We got ’em. First off, scammers are getting smarter and sneakier, always finding new ways to bust in. Keeping up with them feels like chasing a whirlwind. Then, there’s the balance. You wanna make things secure without driving customers crazy with a thousand verification steps, right? And let’s not forget, sometimes tech can be too smart and misidentify genuine users as fraudsters. Yep, virtual transaction fraud prevention is no easy feat, but no pain, no gain, though!

Tips for Businesses to Enhance Security

Okay, business peeps, this one’s for you. Wanna amp up your virtual transaction fraud prevention game? Here’s the scoop. One, invest in fully-loaded security systems. Think of them as the robin to your Batman, keeping your business safe. Two, make sure your employees are fraud-savvy. Get them trained, and keep them in the loop with the latest scam trends. Three, always back up your data. It’ll save your life when things hit the fan. And four, think customer first; sometimes they spot stuff you totally missed!

Wrapping It All Up

In conclusion, guys, dealing with fraud is like waging war against invisible cyber bad guys. They’re out there, plotting away, but with the proper virtual transaction fraud prevention tactics in place, we can put up a good fight. Remember, it’s not only about employing fancy gadgets or software but also about staying alert, informed, and cautious. Whether you’re a digital buyer or a business running the show, being one step ahead of the game is key. Stay smart, stay safe, and keep on rocking those virtual transactions like a pro!